States members voted by a majority to change the main thrust of the 2025 Budget proposals today - paving the way for a joint policy around a temporarily increased income tax rate and then the introduction of GST.

While this does not mean that either the income tax rate will change or a goods and services tax will be introduced, it might give supporters of the ideas some confidence that a majority of deputies are minded to back the revenue raising measures when they're put before them this week.

The 2025 Budget originally proposed a temporary two year increase in the personal rate of income tax to 22%. This additional 2% on the current 20% rate has been presented as a way of bringing in £34million during each of those two years.

However, Policy and Resources President, Deputy Lyndon Trott has always said that still won't be enough money to fill Guernsey's growing black hole.

Despite the prospect of a goods and services tax, coupled with wider changes to the island's tax and social security systems, being rejected just a year ago, Deputy Trott has now backed proposals to put GST back up for debate.

He was the only person who spoke during this morning's very brief debate on rewording his 2025 Budget's flagship proposals to include GST.

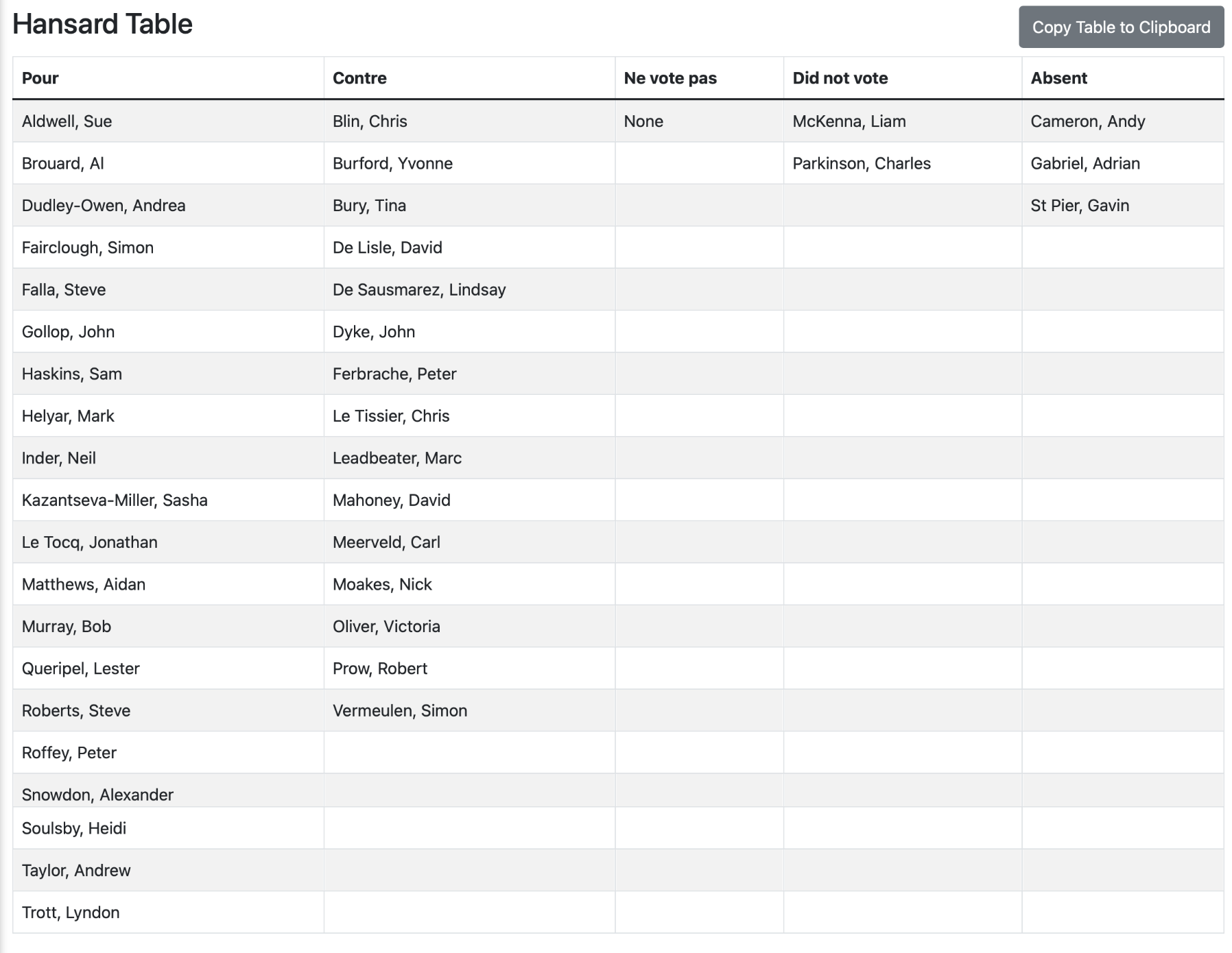

With 20 deputies backing the change, Proposition 1 of the 2025 Budget now suggests the two-year temporary income tax hike, while work is carried out to introduce GST, which would then come in from 2027.

Deputy Trott was expecting this amendment to pass - and he appears confident he will see the increased rate of income tax - now coupled with the future introduction of GST - approved this week too. He pointed out during the debate that there hasn't been any protests against either - as there were against GST a year ago.

Reiterating how Guernsey's financial deficit is now reaching such a rate that the States needs to take action, he said putting income tax up temporarily to 22% while working to introduce GST will set a clear path for the next government to follow.

"Leadership is finding a way forward," he said. "If we can't move forward, we aren't leading anyone anywhere. Leadership is about taking a grown up approach and showing that we can work together as an assembly of 40 individuals with 40 different views. And sometimes, leadership is about setting aside our own strongly held personal views, being calm and objective and saying, 'what is our most important priority here? What do we need to do to achieve it and to do so? Where are we willing to compromise in order to work together?' So I open this debate setting out a vision for a genuinely bright economic future for our island, and that is what I believe in. I believe we need that economic vision, and it is very achievable, but the first step is to ensure we put in place today the financial foundation that allows our successors to develop that vision into a deliverable plan. We cannot leave them to come in on day one after the election with this very urgent problem still unresolved, members. That is our job as leaders. We need to do our job, so that the leaders of tomorrow, can do theirs."

As no one rose to speak during the debate the States went straight to the vote.

With 20 voting for the amendment and 15 voting against, the notion of a temporary 22% income tax rate, until GST is introducing two years later, has now become a reality that the States will vote on later in the debate.

They may vote on the final 2025 Budget proposals on Friday, or a future date will have to be set to finish the meeting off.

Another day, another vote to reject cost cutting in the States

Public sector might be squeezed...slightly

Major corporate tax reform ruled out yet again, but predictions that its time will come

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.