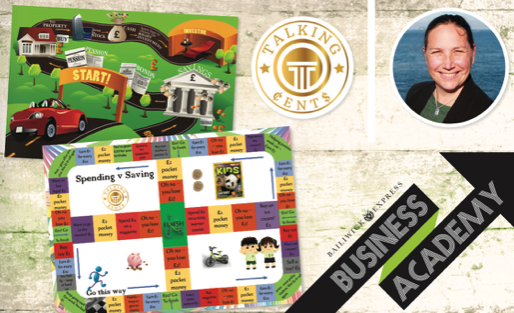

The Bailiwick Express Business Academy is back, and Talking Cents is one of the four finalists.

Talking Cents is a website platform (with a mobile application coming) ‘gamifying’ financial learning in a fun way. Money is a taboo topic and most of us learn through life experience, but we aren’t confident enough to pass these lessons onto our children.

Talking Cents framework is based on existing financial literacy curricula and they’ve created games and stories to liven up the subject.

And because of the effective way Liz Taylor-Kerr has gone about bringing her Talking Cents idea to life, she is one of four finalists in the Bailiwick Express Business Academy. She spoke to Express to talk about what exactly it is she does.

Pictured: Mark Jackson, Co-director of Bailiwick Publishing.

"Learning through practical application is effective, which is why we’ve applied this business model, gradually empowering children through learning objectives, ensuring knowledge and behaviours become ingrained and giving them the knowledge to set themselves up for life.

"I’m a mother with 25 years’ experience in finance - two of my relevant jobs being an investment adviser in a bank and a professional finance tutor, teaching everything from banking to investing to fund administration. I’m Australian but have lived in Guernsey for over 15 years now, and call this beautiful island ‘home.’

"The OECD continually emphasise the need for children’s financial education, and yet until now there hasn’t been a really comprehensive business targeting this niche. Compulsory financial literacy at schools helps to some extent, but asking teachers to teach an unfamiliar subject with no training or experience is unrealistic. The other real problem is that no one teaches money and investing, and yet putting our money in a bank account is no longer enough to ensure a sufficient retirement pot. We need to teach investing behaviours and concepts in a meaningful and relatable way which is where we are focusing our attention.

"In the UK alone, there are 19 million households with children, and 4,000 in Guernsey. Until now there’s been no real guidance for parents teaching their children about the subject of money, despite it being something we are faced with every day of our adult lives. The positive response we’ve received so far tells us there’s definitely a gap in the market which we are hoping to fill.

"Games are fun. Games with tangible rewards are even more fun. Combine that with being able to learn life skills and we think we’ve got an idea with the ‘X factor’.

"Giving parents the opportunity to ‘teach’ their children about money, even if they don’t have the knowledge themselves is something that appeals. We provide the roadmap for parents, so they don’t have to think about ‘what’s next’ to teach their children. We also don’t require parents to have all the knowledge as we break it down into bite sized content and provide all the knowledge they need on the relevant subject so they can ‘consolidate’ (or learn!) as their children do."

Pictured: Bailiwick Express has worked with a number of sponsors who have backed the Business Academy.

The Bailiwick Express Business Academy is sponsored by Natwest International, Jersey Business, StartUp Guernsey, Savills, Carey Olsen, Sancus and Envestors.

Pictured top: Talking Cents.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.