The value of global offshore M&A deals in the first half of 2018 nearly matched the total recorded for the entirety of 2017, according to a report released by offshore law firm Appleby.

The latest edition of Offshore-i, an Appleby insight report on merger and acquisition activity in major offshore financial centres, focuses on transactions announced over the first half of 2018.

Following a similar pattern to most of the world’s regions, the volume of offshore deals has fallen back from levels seen in the latter half of 2017, while value is on the rise. The Crown Dependencies had a strong performance in the first half of the year, with deal volume on the rise in the Isle of Man and Jersey, while the number of deals in Guernsey nearly reached that of the second half of 2017.

“The Crown Dependencies are making a strong showing in 2018, with investment funds and manufacturing companies featuring prominently,” said Wendy Benjamin, Group Partner at Appleby (Guernsey) LLP.

“The International Stock Exchange, which is headquartered in Guernsey, is also reporting impressive growth in the rate of new listings.”

Collectively, the Crown Dependencies showed a strong preference for domestic deals in the first half of 2018, demonstrating faith in the local economies and a recognition that there are local targets worth investing in.

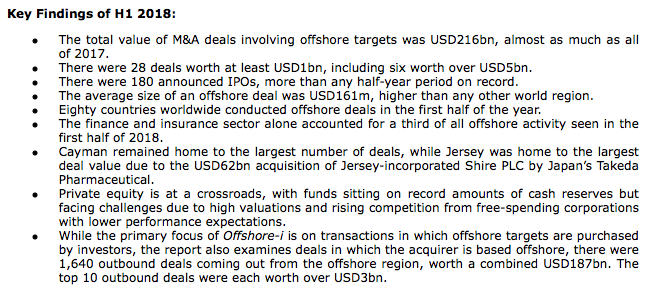

In total, there were 1,344 deals recorded in the first half of 2018, representing a 10% decrease when compared to the last six months of 2017. The total deal value of USD216bn, meanwhile, marked a 68% increase over the second half of 2017 and was driven in part by the USD62bn acquisition of Jersey-incorporated Shire PLC by Japan’s Takeda Pharmaceutical. Each deal in the offshore region’s top 10 was worth more than USD2bn.

Billion-dollar deals have become frequent in the offshore region, with 28 reported in the first half of this year. The surge of big transactions has been bolstered by a desire by boards of major companies to head off disruptive technological threats and accelerate growth, according to the report.

The most frequent types of deals were acquisitions, capital increases and minority stakes in other companies. Typically, these three categories have been fairly balanced but the last 18 months have seen acquisitions move notably ahead to where they now make up 40% of all deals.

Last year saw new highs for offshore IPOs and that momentum has continued into 2018, with 180 companies announcing their intention to go public in the first half of the year.

Cameron Adderly, Appleby Partner, said: “Pent-up investor demand for fast growth investments, including small-cap listings, makes it a good time to go public.

“Economic conditions remain encouraging, equity valuations remain high in many parts of the world and interest rates remain low.”

The top sub-sector for announced offshore IPOs is information service activities, while another popular field is financial services, the report found. Both are benefiting from the positive effects of dramatic change in their underlying industries. Offshore IPOs typically occur on U.S., London or Hong Kong stock exchanges, with Hong Kong being an especially popular choice for the Cayman Islands, the busiest jurisdiction for IPOs.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.