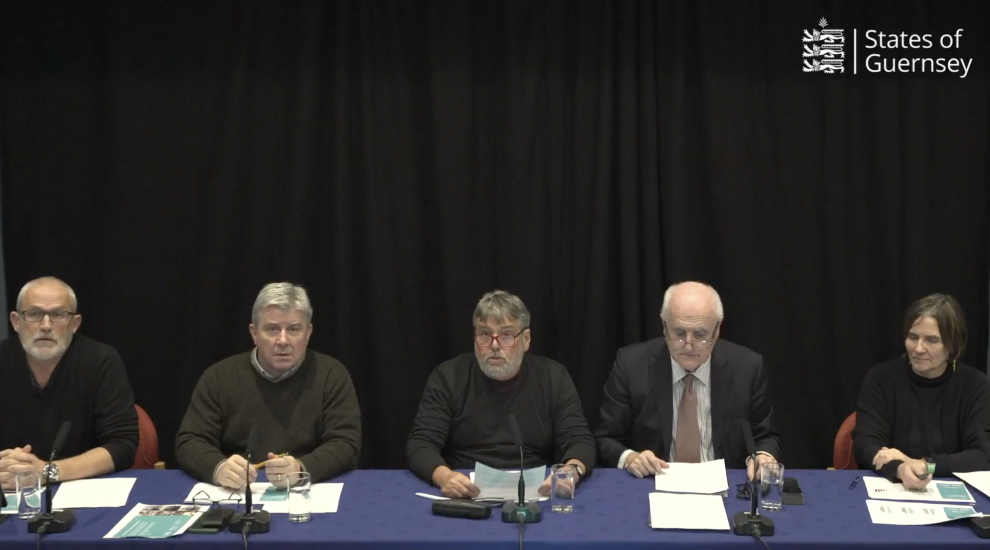

A live question and answer session on the tax review proposals for Guernsey and Alderney fronted by some of the island's most senior politicians and Guernsey's treasurer, saw concerns repeatedly raised about the introduction of a goods and services tax.

Last night's broadcast on Facebook was watched by fewer than 300 people when it was live from 19:00, but the States video has since reached more than 4,400 people - although it's not known how many have watched the full 100 minute discussion or just dipped in for a moment or two.

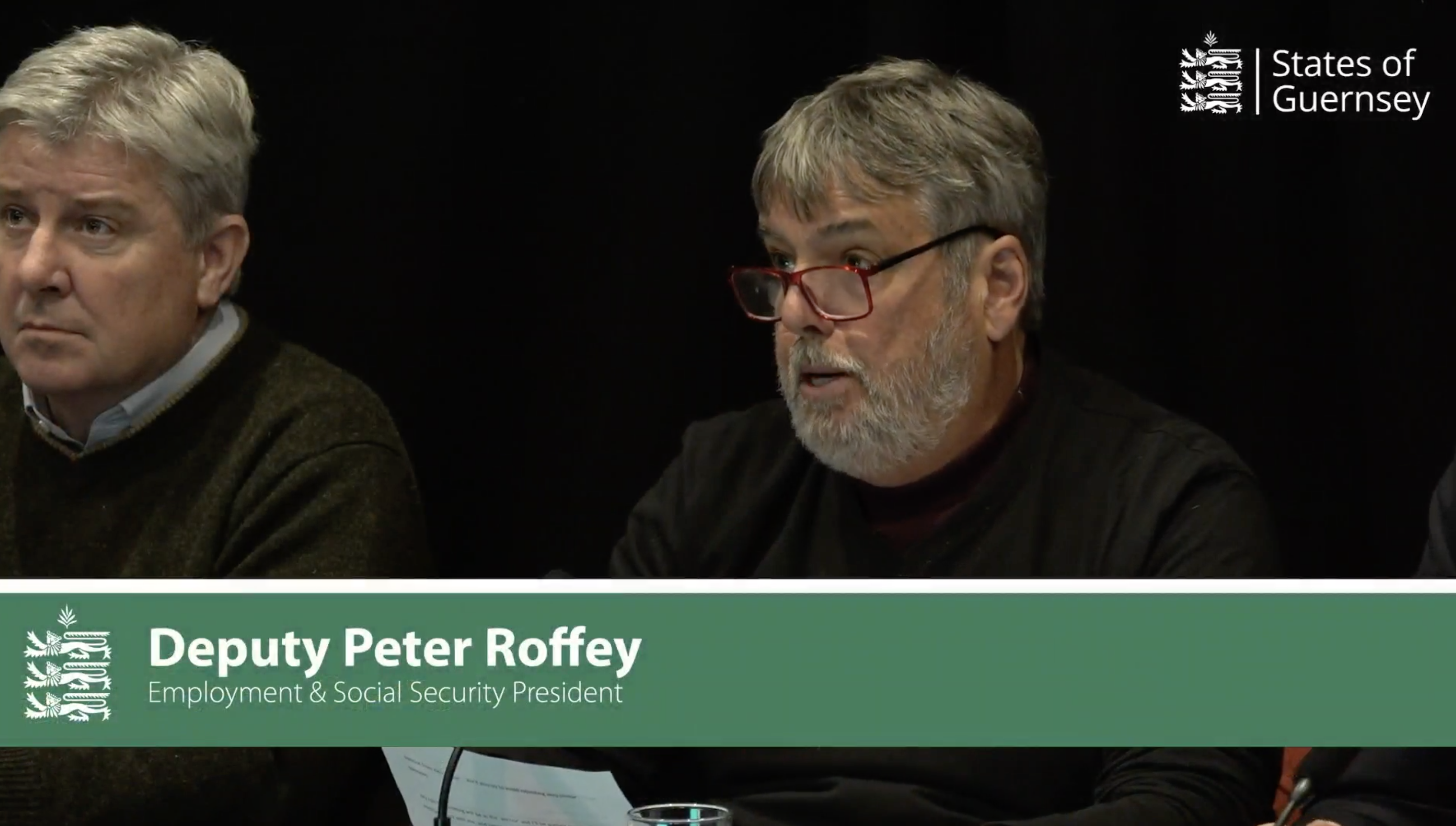

Deputy Peter Roffey was chosen as the front man for the live Q&A.

Pictured: Deputy Peter Roffey, with Deputy Mar Helyar to his right.

The President of the Committee for Employment and Social Security is supporting the tax proposals due to be debated later this month - arguing that the full package of measures, including GST and changes to income tax and social security charges, will mean the lowest paid in the island are better off.

He was seated alongside (l-r) Deputies Dave Mahoney, Mark Helyar, and Peter Ferbrache and the States treasurer Bethan Haines.

Deputies Mahoney, Helyar and Ferbrache are all on Policy and Resources which sets the ground for the island's budget each year and is responsible for tax take and revenue raising measures.

Deputy Ferbrache is the President of P&R and Deputy Helyar is now the Vice President and the financial lead, but neither were central to the discussion last night as Deputy Roffey was tasked with introducing the panel and leading answers to the questions.

The majority of the questions aimed at the panel were focused on GST - with concerns raised about its introduction, the items it will be charged on, the potential of the introduction rate quickly rising, and queries over the research behind the proposed introduction.

While not all questions were answered, the panel tried to cover a range of topics.

Deputy Mahoney explained how the review board had come up with the figures it uses in the proposals, in response to a question from Karl LF on Facebook.

He said that they met with the States controller of Tax in Jersey to ask their advice.

"They've had this (GST) for 13, 14, 15 years, and they came over to Guernsey to give us an update. So really we have drawn on their experience of the actual cost that they are now experiencing in Jersey today and so in terms of estimating we're not actually estimating any costs as these are actual costs that our Jersey counterparts have said, this is what it costs to administer."

Deputy Helyar echoed that by further explaining that "the estimates that we've used are the real life estimates from Jersey. We know how many staff they have, we know what they get paid, we know what difficulties they've had and we've applied some money towards helping with training and other aspects of it.

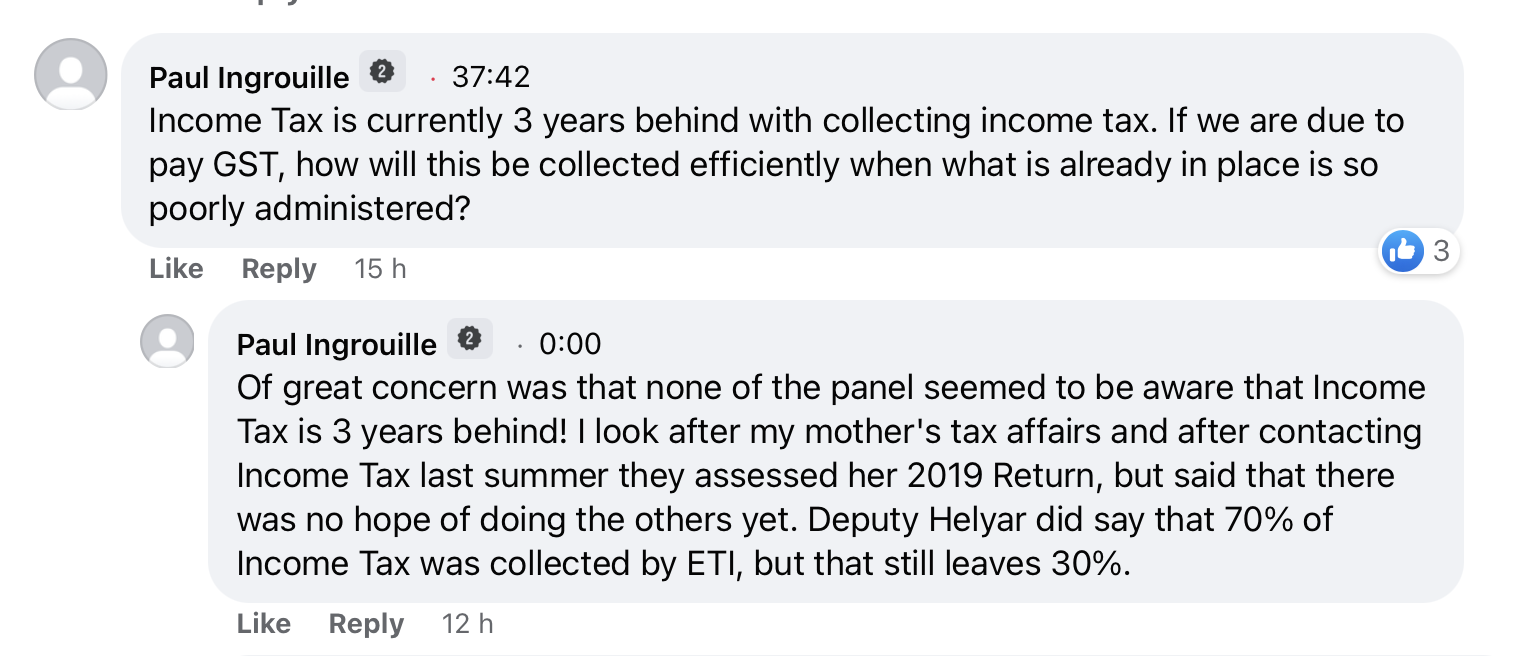

One man, who also completes his mother's tax returns asked how the island's civil servants will be able to adequately manage a new form of taxation when there remains a backlog in assessing income tax returns.

Pictured: Questions were posed via Facebook in comments beneath the live streamed video.

Ged Hussey asked the deputies proposing GST to enter into a live debate with those opposing the new charge.

Deputy Ferbrache pointed out he has tried to do so and not been successful.

"I offered with Deputy McKenna, who made that wonderful video about no GST. I don't think it's about anything else except no GST, it reminded me of a song. (I offered) to have a debate with him, to have an open debate with him but for reasons only known to him really he decided not to do so. But to answer Ged's question I'm quite prepared to have a debate with any deputy singular or plural, who is opposed to GST, face to face to use Ged's phrase, both parties could be properly scrutinised."

Other questions centred on the increasing rate and the impact on the working age population, and the wider costs of living in the island.

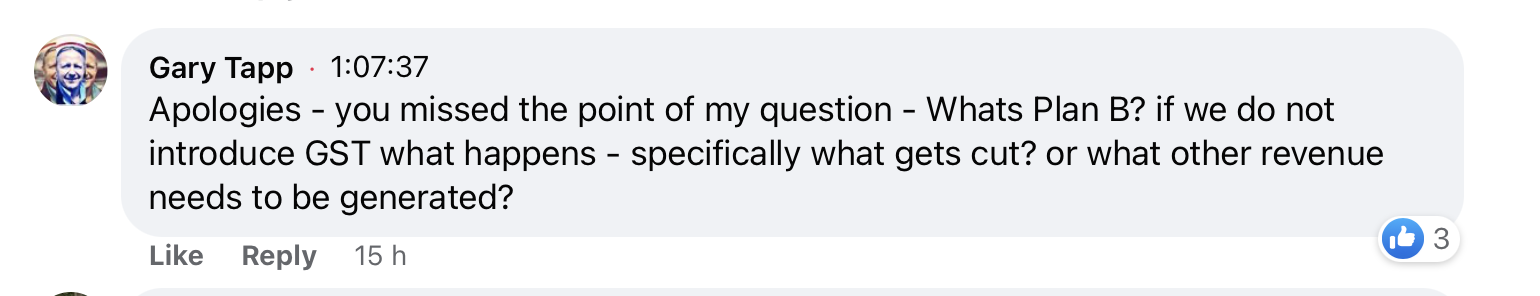

Pictured: Some people felt that their questions weren't answered or were misunderstood.

There was a feeling among some people watching the Q&A sessions that their concerns weren't being addressed and questions were either being ignored or were misunderstood.

There was a limit to how long the event could last so not all questions could be answered.

Further public events are being held in Guernsey and Alderney to explain the tax proposals face to face with people.

P&R President wants head-to-head public debate with tax critic

Talks held to keep Sark free of GST

ANALYSIS: The States' biggest test

Former Vice President reveals opposition to P&R tax plan

Social security changes help poorer families and 'middle Guernsey'

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Treasury chief won't lead tax plan

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.