A think tank has proposed a tax system which includes both a goods and services tax and a territorial corporate tax regime, as local lawmakers prepare to agree on the direction of travel for funding public services next week.

Dr Andy Sloan, former States of Guernsey economist and founder of the International Sustainability Institute, laid out his vision for a flat rate of tax across the board, as well as a territorial system to address declining rates of growth and productivity, as well as demographic challenges.

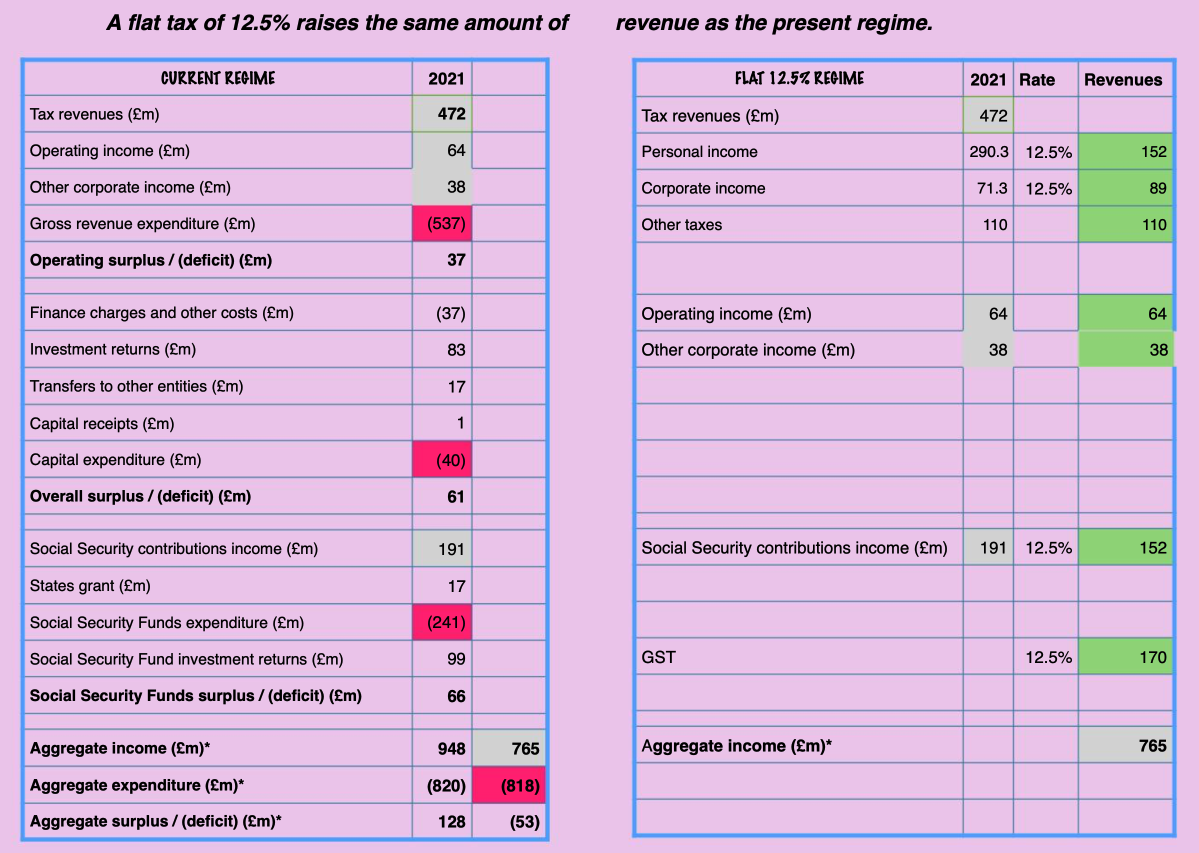

It comprises a 12.5% income tax, social security rate, corporation tax, and goods and services tax.

He argued this approach could “improve competitiveness and widen the tax base” simultaneously, and that locking in these tax rates would “encourage spending discipline”.

He believes this would broaden the base better than Policy & Resources’ tax and social security package which will be challenged in the States next week.

Such a system would also go some way to “getting the monkey off our backs” in terms of being perceived as a tax haven and prevent “unnecessary antagonism” from organisations like Moneyval, said Dr Sloan.

But he accepted as an economist he was able to take liberties and not worry himself with implementation concerns or the political challenges which arise.

You can read the full paper HERE.

Pictured: Dr Sloan presented his analysis to around 100 people at the Old Government House Hotel yesterday.

Dr Sloan accepted that establishing a territorial tax system would be politically and technically challenging but said it “should not be impossible to put in place”.

“I believe it's sustainable, but getting there is tricky,” he said, adding that the costs of implementation for government and businesses may prove too high.

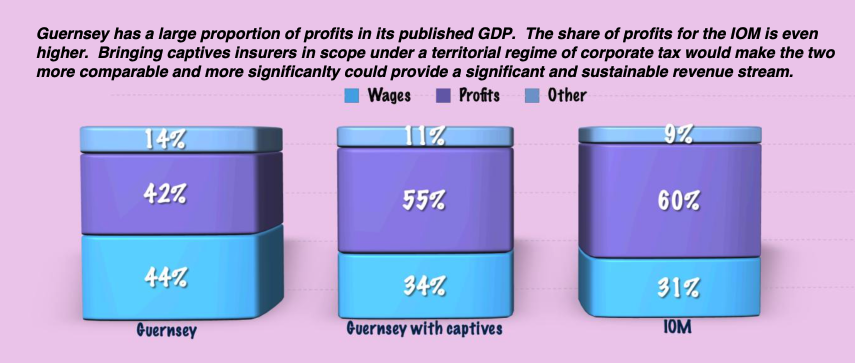

But he called it a “prize we ought to be looking at” which could “raise significant revenue if you want it” and would largely be generated from taxing captive insurance companies, which are highly prevalent in Guernsey.

A global minimum rate of corporate tax of 15% by 2024 as proposed by the OECD means the Crown Dependencies need to “quickly develop a roadmap to getting there”, according to Dr Sloan.

If such a system could raise tens of millions per year, he believes it would give legroom for the other elements of the system – including a GST – which he defended as being “efficient” since “we are all consumers”, and that if more public services are voted on and agreed “we’re going to have to pay for them”.

He said GST as proposed by P&R “won’t do anything to address the widening imbalance” between household and corporate taxation, which he said has increased by 18% in real terms for people.

Pictured: Captive insurance companies are a form of self-insurance where a non-insurance company sets up and owns an insurer to manage its own risks. The Isle of Man does include captive profits in its GDP calculation. Credit: ISI.

Dr Sloan questioned why a jurisdiction should “give up the opportunity to do something radically different” if it has been working since 2010 on reviewing its taxation system and said if deputies do not consider it next week the opportunity may be lost forever.

He said Jersey is in “a very similar situation” with a declining finance industry and poor rates of growth, insinuating that Jersey is likely waiting to see if Guernsey introduces a GST of 5% before attempting to raise consumption tax to 10% to address its fiscal deficit.

Since 2009 costs for the finance sector, such as compliance costs driven by scepticism of the 0% tax rate, had a “huge impact” on the Gross Value Added of the industry.

Simultaneously, professional services businesses, such as the top-four accounting firms, have expanded, but their services are additional costs to the rest of the industry.

“The work Guernsey does is falling down the values chain,” Dr Sloan said, adding that large parts of the finance industry are now just providing “administrative services”.

Pictured: A flat rate of 12.5% is suggested to raise the same amount of revenue as the current system. Credit: ISI.

The proposals were met with scepticism by some in the audience, however.

One questioned if offshore jurisdictions would simply continue to operate 0% corporate tax rates and “give two fingers” to the OECD, suggesting that the Cayman Islands and Jersey could follow that route.

Deputy John Dyke said Cayman had already indicated doing just that.

They also said the USA and EU are at loggerheads over the Pillar Two aspect of the global minimum tax proposals creating uncertainty for business.

Another said the paper did not adequately consider client behaviours or capital gains taxes.

Consumption tax rises “inevitable” without improved growth

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.