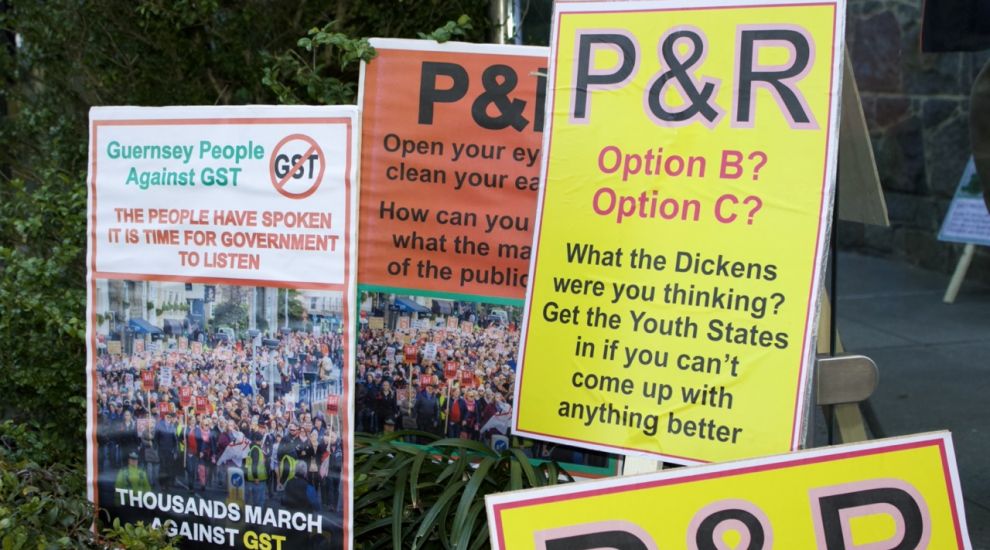

States members failed to back any of the significant tax packages after a dramatic conclusion to debate.

Policy & Resource's proposals, which included GST, lost by 25 votes to 15, but deputies then failed to rally around an alternative.

The main opposition package was Option D, proposed by Deputy Heidi Soulsby, but the vote on that was tied 20-20, meaning under the rules of the States the status quo prevails, in other words the current tax and benefits system.

It all followed six days of debate which extended late into Friday evening beyond their usual cut-off time.

Members did back some work:

Deputy Heidi Soulsby led the Option D amendment.

Pictured: Deputy Heidi Soulsby.

During debate she said no options were perfect, but said members could not let their desire for perfection become procrastination.

People had not been convinced by GST, she said.

"The public wants us to demonstrate expenditure restraint," said Deputy Soulsby.

Some may not like transport related taxes, others may not like property taxes, but revenue does need to be raised, she said.

"Option D provides a way forward, delivering through a staged approach, expenditure restraint, savings and revenue raising, requiring the identification of a long term vision for Guernsey and then an accompanying economic social environmental model. The consideration of alternative funding models for capital projects and the development and delivery of revised health and care models. No other option does that. It sets us on a path for growth and actually a proper review of corporate taxes. It is the only option that has any chance of helping to restore the public's trust in this government is the only option that says we understand what you're going through trying to raise a family trying to run your own business trying to make ends meet. It is saying we need to raise revenues, but that we'll make a pact with the community to limit this as far as we can."

What were the five options?

Policy & Resources' Treasury lead Mark Helyar warned that a “tragic and destructive thing” was about to happen to our economy.

“In just 17 years time, there will be 5,500 more pensioners. It's already difficult to find places for people to go into elderly care. There are many, many people holding and blocking beds in our hospitals. And we can't afford to look after them. We are running out of money and that means we need to make very, very difficult choices.”

He said GST would happen because there was no credible alternative which was capable of doing the heavy lifting.

It was a broad, easy to collect, simple to administer tax, he said.

One of the most important things about P&R’s package was that it was a reduction in taxation for 60% of households, he said.

“It's incredible that this hasn't been talked about more and a 15% reduction of income tax or reduction of income tax of 5% on the first £30,000 of earnings, a complete restructure to make the Social Security system far better, bigger personal allowances and income tax allowances and social security which people don't have at the moment. The poorest in society will benefit from option A. They will not benefit from any of these other proposals. None of them.”

After a successful amendment from Deputy John Gollop, if accepted, GST would not apply to food either.

“So it’s even fairer,” said Deputy Helyar.

He said you could not measure popularity from noise on the internet.

“We cannot simply say that this cannot go through because it's not popular because it's never going to be popular with everybody.”

He said that Option D would lead to the island “limping along for several years”.

“We won't just be making the mountain higher. We'll be making a huge cliff at the other side of it. And our children will be paying for it in 20 or 30 years, for our pensions that we can't afford, and that is not acceptable. It's not acceptable. And I'm willing to stake my political life on doing the right thing which is Option A and members, you should do the same thing.”

A former Treasury minister, Deputy Lyndon Trott, said that if Guernsey achieved 3% growth and sustained it, or if productivity was 5% higher, “we wouldn’t have the problem we have today.”

“If I was a benign dictator, I would be supporting Option A, but I'm not. I live in a democracy. For me, it's quite clear that Option A has very significant opposition. Now, I'm the first to accept that much of this opposition is ill founded, but the opposition is there nonetheless.”

He said that P&R could have won hearts and minds if they had been a little bit more assertive, front footed and positive.

“P&R simply didn't do enough.”

Because of the incremental nature of Option D, and importantly because it deals primarily with existing tax mechanisms, its implementation is almost certain to proceed.

“As I said on day one of this debate, GST is dead in the water for now. My guess is that a future Assembly will find themselves considering this again, and I think there will be lessons learned from this debate. But right now, the sensible pragmatic way forward is to support Option D.”

Employment & Social Security president Deputy Peter Roffey has been a vocal supporter of P&R’s original package.

“What I really don't want to do more than anything else is leave the fiendishly difficult task of tackling our systemic deficit which is brought on by one thing and one thing only, which is changing demographics, and it's no different in Guernsey to China to America to Japan… and I really fear that what's going to happen at the end of the day, nine o'clock tonight or whenever it is, we're going to leave that mainly for our successors to deal with and I’ll be ashamed if that happens.”

He said he hated the idea of GST, but sometimes in life we have to do things we do not want to.

“This is one of those instances. And to me, Option A is the least bad option and the five on the table and by an absolute country mile.”

Health & Social Care President Al Brouard said that Option D was just fluff.

“It reminds me of a billboard on a development site. It's one of those great big billboards and there's a lovely family standing in front of a beautiful house, but when you actually look behind the billboards there's just a wasteland because nothing's there yet.”

He said that States members have more information than the public and had to use it wisely.

“And it goes far beyond slogans that say no GST, we've got to be far more responsible as a government than just those headline figures or those headline words. And here am I, supporting a GST with the mitigations for those who are on lower incomes, when I was originally against the GST in the years gone by, having taken lessons from colleagues who used to promote a GST for years with the explanations we need to broaden our tax base, etc, etc. and now those colleagues don't want one, or this one, or not at this time. You can't make it up.”

Deputy Sasha Kazantseva-Miller warned about the huge tax burden of P&R’s approach.

She said that £75m. in new taxes would represent about 10% of the current total taxation including social security contributions.

“This will also represent a nearly 40% of increased total burden of personal taxation that households have had to endure for the last 14 years, just like that.”

The States should, to an extent, look at the options in front of it as damage limitation.

“The Fairer Alternative proposals, what they're trying to do is to provide a staged approach and to really show that we don't have the right to put such a huge burden of increased taxation today on our economy, be it on corporates, but especially on households. The Fairer Alternative is the only proposal in front of us that is giving us the option of a two staged approach.”

Deputy Gavin St Pier said that Option D was a fairer package of measures which included in stage one very modest expenditure restraint and ensuring revenue raising is borne by those with the broadest shoulders.

Its staged approach allows for more time for the work that needed to be done to restore the public’s trust.

Former Treasury minister Deputy Charles Parkinson said that none of the options on the table addressed the fundamental problem of very slow economic growth.

"And the pressures on public expenditure are growing at 2% per annum and we are just, frankly, playing with numbers and words and shuffling the deck chairs on the Titanic to to try and reorganise things so that somehow this doesn't turn out quite as badly as it might otherwise do."

There was no economic plan in place, he said.

"We certainly have no tax reform in place or even on the table which which would have the semblance of the foundation of an economically sustainable growth rate."

He was tempted to think that coming out of the debate with nothing might not be the worst option.

"I share the views of those who say we cannot now get a GST in place by the next General Election anyway. So it is going to be a huge election issue, whatever we decide, and maybe we just have to leave the the slate as clean as we can, so that the next States can start off without a load of baggage which are half conceived, and half formed plans that we may have imposed on them."

How they voted on P&R’s Option A:

For: Sue Aldwell, Al Brouard, Andrea Dudley-Owen, Peter Ferbrache, Mark Helyar, Neil Inder, Jonathan Le Tocq, David Mahoney, Nick Moakes, Bob Murray, Victoria Oliver, Rob Prow, Steve Roberts, Peter Roffey, Alex Snowdon. 15

Against: Chris Blin, Yvonne Burford, Tina Bury, Andy Cameron, David De Lisle, Lindsay De Sausmarez, John Dyke, Simon Fairclough, Steve Falla, Adrian Gabriel, John Gollop, Sam Haskins, Sasha Kazantseva-Miller, Chris Le Tissier, Marc Leadbeater, Aidan Matthews, Liam McKenna, Carl Meerveld, Charles Parkinson, Lester Queripel, Heidi Soulsby, Gavin St Pier, Andrew Taylor, Lyndon Trott, Simon Vermeulen. 25

How they voted on the Fairer Alternative Option D:

For: Yvonne Burford, Tina Bury, Andy Cameron, Lindsay De Sausmarez, John Dyke, Simon Fairclough, Steve Falla, Adrian Gabriel, John Gollop, Sasha Kazantseva-Miller, Marc Leadbeater, Aidan Matthews, Liam McKenna, Charles Parkinson, Lester Queripel, Heidi Soulsby, Gavin St Pier, Andrew Taylor, Lyndon Trott, Simon Vermeulen. 20.

Against: Sue Aldwell, Chris Blin, Al Brouard, David De Lisle, Andrea Dudley-Owen, Peter Ferbrache, Sam Haskins, Mark Helyar, Neil Inder, Chris Le Tissier, Jonathan Le Tocq, David Mahoney, Carl Meerveld, Nick Moakes, Bob Murray, Victoria Oliver, Rob Prow, Steve Roberts, Peter Roffey, Alex Snowdon. 20.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.