The Directors of Sark Shipping managed the company’s finances in a way that could have led to the business being placed in administration, the island’s Policy & Finance Committee has said in damning allegations that have been put to Sark’s Government.

Sark’s senior committee is urging Chief Pleas to remove the entire board of Isle of Sark Shipping from office with immediate effect due a number of “failings” that P&F say have threatened the future of the company.

Sark Shipping Managing Director Yan Milner said in an open letter that he and his fellow Executive and Non-Executive Directors had been issued with an ultimatum by P&F – resign en masse or face a motion in Sark’s Government calling for their heads.

In a statement on behalf of the Board, Mr Milner accused P&F of acting in a “secretive and under-handed” way and not behaving in a way that put the best wishes of Sark first.

P&F has published papers and documents containing their side of the story.

Pictured: The Sark Venture has been out of service since January for work that was only supposed to take four to six weeks.

On 31 March 2020, Sark Shipping purchased the Corsaire des Isles – as a replacement for the Bon Marin - using its cash reserves, an overdraft facility of £150,000 (guaranteed by Chief Pleas) and a further unsecured overdraft of £50,000.

A guarantee for a secured loan in the sum of £300,000 was signed by Chief Pleas on 6 April 2020, P&F Chairman Peter La Trobe-Bateman said.

“The company's bankers indicated that, if they were to advance funds on the guarantee, they required a letter of comfort signed by Chief Pleas to the effect that the guarantee would no longer be against a secured loan, but against an unsecured overdraft to fund general expenses," he said.

“A guarantee for unsecured lending of £450,000 (ie £300,000 plus the existing secured overdraft facility of £150,000) was unacceptable to Policy & Finance and the letter was not signed.”

On Sunday 3 May, Mr La Trobe-Bateman said the ferry company's Finance Director Paul Burnard stated, in an email that, "Absent any funding by next Weds (sic) he would be recommending to the Board that we apply to the Court to – at the very least – place the Company in administration.”

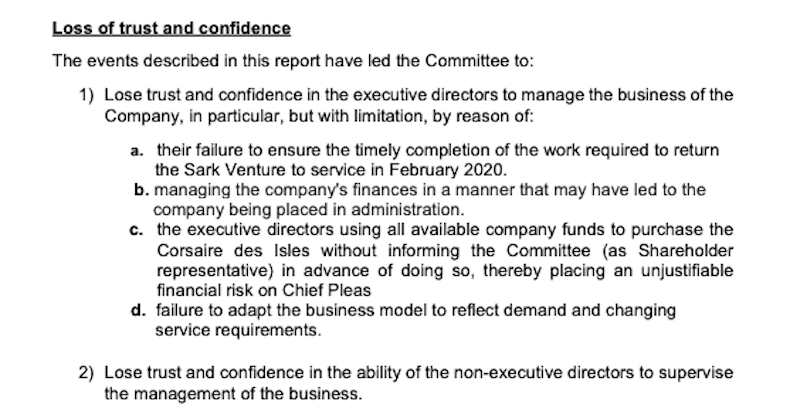

Pictured: The reasons given by the P&F Committee for its loss of trust and confidence in the Board of Isle of Sark Shipping.

P&F says that it then worked with the bank urgently to establish a financial package to enable the company to continue trading.

Mr La Trobe-Bateman said the company was informed of the States of Guernsey’s support schemes as the corona virus hit, but that it waited 14 days before writing to its bankers stating that amount required £775,000 which was in excess of the upper limit of £500,000 under the scheme.

A final application for support under the GSS was submitted on 29 April with an expected turnaround time of four/five working days.

“On 3 May, within the timeframe for an expected reply, the company's Managing Director wrote an email to the Committee stating that, without funds, the company would be placed in administration within four days,” said Mr La Trobe-Bateman. “On enquiry Policy & Finance was told that there were no creditors pressing and no outstanding judgments.”

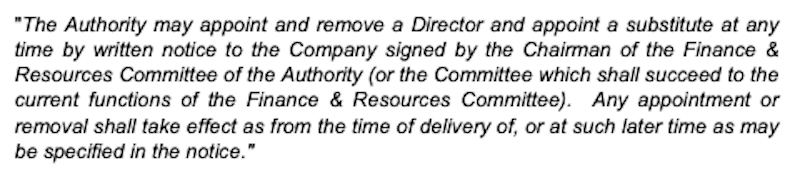

Pictured: The rules of procedure under which Chief Pleas is able to remove Directors of the company.

“In May 2020, the company's worsening financial position eventually led the Board and the Committee to agree a redundancy exercise. The projected cost of the redundancy exercise was more than £50,000 (in excess of the unsecured overdraft facility). This led to the company's bankers requiring a further financial injection from Chief Pleas into the company of £30,000. This additional funding was approved on 7 May.

“The provision for redundancies was almost immediately removed from the company's financial reports. The Committee was given to understand that redundancies were not implemented at the request of the States of Guernsey, although this remains unverified.”

P&F has also highlighted Sark Shipping’s management of its fleet replacement and maintenance, as they have been left with just the Sark Belle to operate sailings since restrictions within the Bailiwick eased and the ferry company was once again able to offer passenger sailings.

The Sark Venture is out of service and has been since January 2020, when it was withdrawn from service for refurbishment, with a reported timeframe for return to service of four to six weeks. The Corsaire des Isles remains in France, awaiting confirmation of a delivery date.

Pictured: Sark Shipping has reportedly experienced a marked drop in passengers this year, partly due to only having one vessel in service in recent months.

Mr La Trobe-Bateman said his committee has raised its many concerns Sark Shipping Directors, but to no avail.

“The Committee met with the non-executive directors on 10 August to discuss the reasons for its loss of trust and confidence in the Executive Directors and, more widely, the Board, and to give the non-executive directors the opportunity to respond to its concerns.

“The Committee's concerns were not allayed by anything said by the Non-Executive Directors at the meeting.”

“It is the Committee's view that, to establish good communications between the Committee and the Board, restore trust and confidence and secure the lifeline service provided by the company, the Board should be replaced immediately with the minimum number of directors required to comply with the company's articles and the employment of the Managing Director and the Finance Director should be terminated by the company with immediate effect.”

At last night's meeting of Chief Pleas, P&F proposed that:

all the directors to resign in writing from office, with immediate effect;

in the event of any director failing to resign, that director to be removed from office with the approval of Chief Pleas;

the Finance Director's termination date to be brought forward by the company;

the Managing Director to be given immediate notice of termination by the company;

However, debate on the matter was postponed and is due to be picked up again in Thursday evening's meeting.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.