The Guernsey Retail Group warns their industry will be decimated if a goods and services tax is introduced in the island.

Chaired by Jonathan Creasey of the eponymous family run chain of stores, the GRG said a survey of members has proven they have fears of a "detrimental impact" if GST is brought in in 2025.

Next week the States will debate the Tax Review which recommends a 5% GST along with wider changes to income tax and social security charges. If approved the new tax would come in in 2025, the same year the next general election is due to be held.

The GRG says even with a two year introduction period, a sales tax "would make local businesses uncompetitive" and that it is "concerned of the harmful effect this would have on community centres including St Peter Port, St Martin’s, St Peter’s and The Bridge".

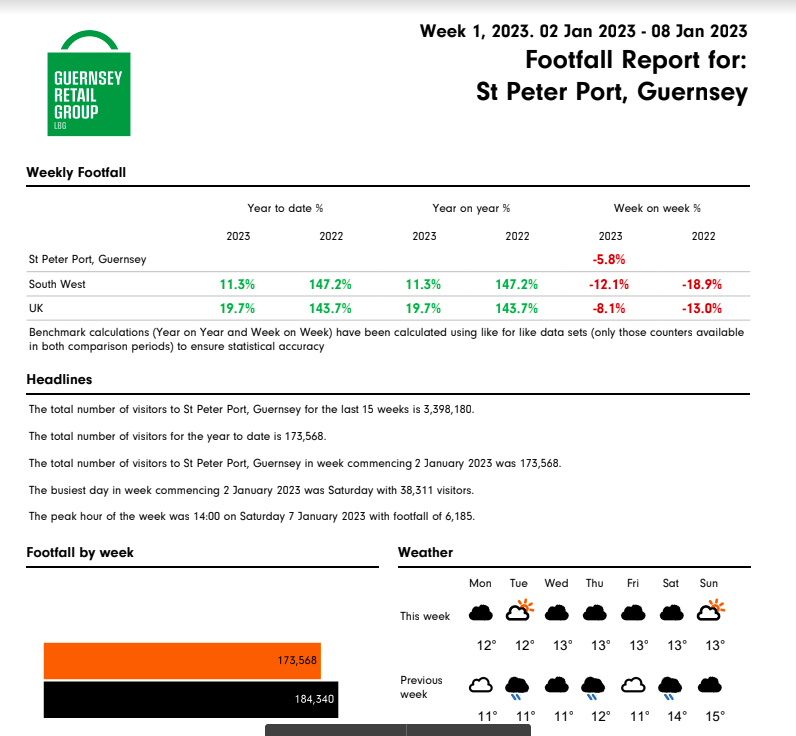

Pictured: The latest 'footfall report' carried out by the Guernsey Retail Group.

The GRG carries out regular surveys of its members and monitors footfall and occupancy rates in retail areas.

It's most recent footfall survey found 173, 586 people visited St Peter Port's shopping centre during the first week of this year. That was lower than the week before and figures for the previous year aren't available.

The most recent Occupancy Report for Q3 2022 showed the number of vacant shops held steady last year following a reduction in vacancies earlier in the year.

Korinne Le Page, Head of Retail Development at the GRG said these statistics all demonstrate a positive retail economy but she warns GRG members remain worried about GST.

"The outcome of our poll to members shows that many feel they would close or downscale if this tax is introduced, which would be very harmful for Town and other centres and naturally reduce the choice for local consumers.

"We believe this would negatively impact on our local community and completely ignores the value retail brings to the Island. The sector here has recovered well from the pandemic as our shop vacancy rate stands at 7.8%, comparing favourably with the UK which is running at 13.9%.

"This is not the time to introduce a new, blanket tax when inflation and the cost of living are so high. Timing could not be worse and even if this comes into effect in two years, we have learned that the impact of inflation is long lasting and yet another hurdle for businesses to overcome, in addition to increased import costs, staff shortages and the ongoing threat of online shopping."

In the survey, GRG members said GST could add substantial costs for changing tills, introducing systems to collect and report tax and the time necessary for administration. All these additional charges would have to be borne or passed on to customers.

Ms Le Page said that could result in shops closing.

The GRG is also concerned how a new tax would be perceived by visitors to the Island, particularly with a proposed threshold of £300,000 annual turnover determining whether or not a retailer charges GST. Ms Le Page said Guernsey won't be attractive as a low tax holiday jurisdiction any more.

"Even with the £300,000 level, not only would Guernsey be seen by tourists as now having a sales tax, it also doesn’t necessarily mean businesses with a higher turnover have sufficient funds to spend on the various changes that will have to be made. Also, this threshold will thwart growth as some retailers will want to remain below that figure.

"We strongly believe that that all the alternatives which could address Guernsey’s financial issues should be seriously considered, as the unintended consequences of GST could have a substantial and long lasting impact on our whole community as well as the economy."

Alternative tax package promises greater States savings

Social security changes help poorer families and 'middle Guernsey'

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Former VP reveals opposition to P&R tax plan

ANALYSIS: Resignation another symptom of the most divided States

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.