Deputy Peter Ferbrache is challenging GST critic Deputy Liam McKenna to a public debate on tax and funding public services.

The President of the Policy & Resources Committee issued his challenge late on Tuesday afternoon after Deputy McKenna released a video at the weekend condemning the Committee's plan to introduce GST by 2025 alongside other tax changes.

Deputy Ferbrache told Express that Deputy McKenna's video "perpetuated completely baseless myths" and said a head-to-head discussion between them would provide "informed and serious debate...without the populist rhetoric".

He appealed to the media to organise and present a head-to-head debate or interview and invited editors to put forward ideas about how to set it up.

"I'd very much like to debate this openly and in public with Deputy McKenna, and I very much hope he accepts the offer," said Deputy Ferbrache.

Video: Deputy Liam McKenna's two-and-a-half minute 'say no to GST' broadcast which prompted Deputy Peter Ferbrache's suggestion of a public debate between the two men.

In a video published on his Facebook page, Deputy McKenna spoke of "GST to avoid civil service job cuts, GST to punish every Guernsey family [and] GST to cover up Government's failure to control its spending".

He characterised the States as a place "where instant gratification is no longer quick enough".

"No one should ever agree to GST - a great tax increase when the Governor of the Bank of England has said we are facing the greatest recession in history," said Deputy McKenna.

He also said GST would contribute to "our children and grandchildren being forced out of the island where they were born".

Pictured: Deputy Liam McKenna is concerned that GST could help drive young Guernsey couples out of the island.

Deputy Ferbrache defended his Committee's tax plan and suggested that Deputy McKenna's analysis was unrealistic and irresponsible.

"I genuinely welcome all contributions as we try to solve the incredibly serious challenge of how to ensure health, pensions and other essential services can continue to be funded as demand for those services grows. It's a problem I wish we didn't have, but one we cannot continue to ignore," said Deputy Ferbrache.

"But it is incumbent on all responsible States' members who are opposed to our recommendations to put forward realistic and thought-through alternatives.

"Incredibly, Deputy McKenna also rails against the growing pressure on our health service and pensions, which is precisely the problem the tax review is looking to solve.

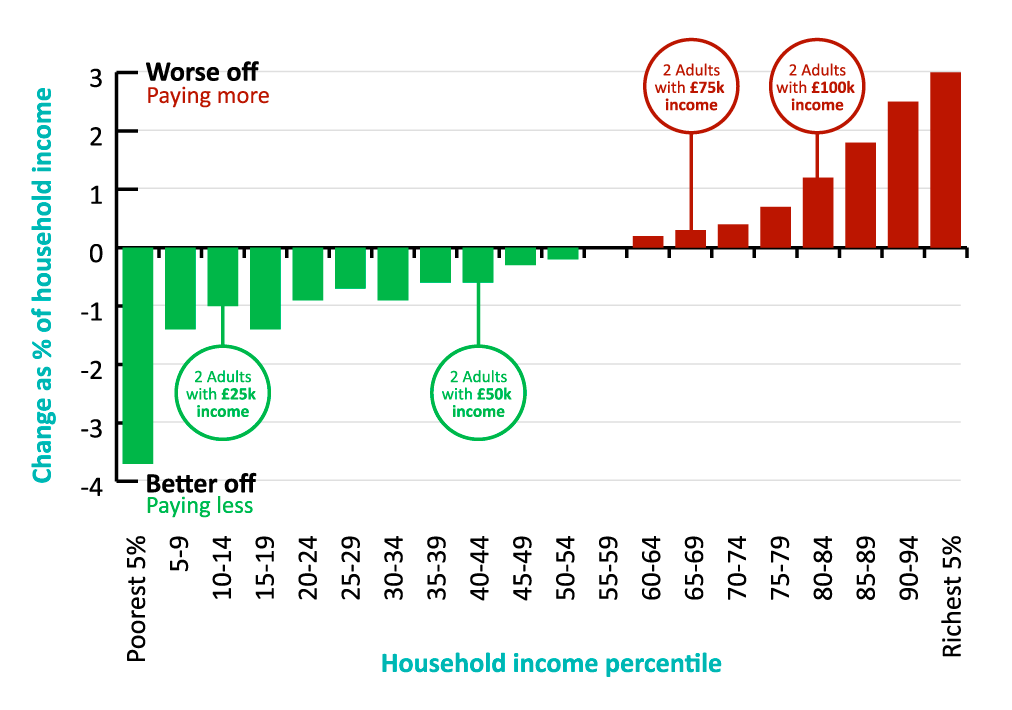

"And he ignores entirely that our fully fleshed-out recommendations will see most lower- and middle-income households better off compared to now."

Pictured: The Policy & Resources Committee has published this chart to support its assertion that GST could be introduced as part of a package which would leave most low- and middle-income households better off.

The Committee estimates that its proposed changes would boost States' income by £55million a year towards a funding gap in States' finances which it now projects could be as large as £140m a year in the long term.

Alternatively, it has warned that spending on public services will need to be reduced by around 12% by 2026.

The Committee said the overall effect of its tax plan would leave most families better off with only the most affluent 40% of households paying more.

The Committee's tax plan is set to be debated by the States' Assembly in January.

Pictured: Deputy Peter Ferbrache believes that a head-to-head debate or interview would help reveal that Deputy Liam McKenna's analysis of the States' financial position relies on "completely baseless myths".

Deputy Ferbrache said he was offering "a public debate or head-to-head interview with Deputy McKenna having seen Deputy McKenna’s most recent 'say no to GST' social media video and some of the coverage around it".

In the video, Deputy McKenna said that Deputy Charles Parkinson "believes we could generate millions from corporation tax - and I believe Charles is right".

Deputy McKenna also criticised the performance of the States generally, speaking of a generation of locals "financially crippled with ever increasing food, electricity, gas and petrol, mortgage interest rates rising, secondary pensions and now GST".

"With over 2,300 of our Guernsey community on the orthopaedic waiting list for operations, 70 vacancies in mental health, a nursing shortage, an allied health care shortage, a housing crisis, our children staring at becoming generation rent, rising costs of food and fuel, pensions embarrassingly low, heat or eat, this is not acceptable," he said.

"We deserve Guernsey to be better than this because Guernsey is better than this."

Express invited Deputy McKenna to respond to Deputy Ferbrache's challenge of a head-to-head debate but he was unable to reply before publication.

Pictured: The members of the Policy & Resources Committee faces a tough challenge to secure the approval of the States' Assembly for its far-reaching tax plan and get it introduced before the end of the States' term in June 2025.

Pictured (top, l to r): Deputy Peter Ferbrache, President of the Policy & Resources Committee, and Deputy Liam McKenna, who wants the States to reject the Committee's proposed tax plan.

Talks held to keep Sark free of GST

ANALYSIS: The States' biggest test

Former Vice President reveals opposition to P&R tax plan

Social security changes help poorer families and 'middle Guernsey'

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.