Staring down the barrel of political defeat, Policy & Resources pulled back its proposals for a GST – at least for now - and vowed to enter “listening mode” about future tax reforms.

The shock announcement that the States’ senior committee wanted to scrap its original proposals – which sought political agreement that a GST is needed if the States is to meaningfully diversify its tax base – came just minutes before the delayed debate resumed yesterday.

“We’re admitting we are wrong,” said Treasury Lead Deputy Mark Helyar, adding that more consultation was needed in light of views inside the debating chamber and out in the community.

The majority of speeches made when debate started a fortnight ago indicated those speakers would not support P&R’s green paper.

In an amendment to those original propositions – which were designed by P&R to avoid amendments from the floor of the house – P&R instead asked States members to note the Tax Review policy letter and:

"Investigate the options for raising additional revenue from corporates, having due regard for the need to retain an internationally acceptable and competitiveness tax environment."

"Undertake a period of extensive consultation and engagement with States Members, the business community and wider public stakeholders."

"Report back to the States with detailed proposals for a restructure of the tax base and its phased implementation, by no later than July 2022."

The Committee said it "will take into account views voiced during debate including the desire expressed by some members to raise additional revenue from corporates.”

Policy & Resources Vice-President Heidi Soulsby said the Committee has “listened, and we very much feel we needed to listen, and make an amendment that reflected the debate”.

Some deputies lamented not being informed of P&R’s intentions sooner, suggesting that their ability to scrutinise the detail of the new proposals was extremely limited by the timing.

Deputy Bob Murray was concerned that the amended version did not contain any explicit commitment to reviewing the States’ current spending levels, unlike the original propositions.

Guernsey Party colleague Deputy John Dyke also noted that Proposition 2 from the original green paper had not been replicated in the amended propositions.

Former Treasury Minister Deputy Lyndon Trott questioned how realistic P&R’s mission statement on corporate taxation actually is, saying that international competitiveness and acceptability “are rarely co-aligned”.

Others commended P&R for acting “pragmatically” by reading the temperature of the room. Others were more cynical, suggesting the move was motivated mainly by a desire to sidestep “a deeply embarrassing defeat of a flagship policy” and the explicit political rejection of a GST.

P&R President Peter Ferbrache reiterated the view that there are few reasonable alternatives to a GST if the island needs to raise an extra £80m a year in response to long-term deficits in public finances.

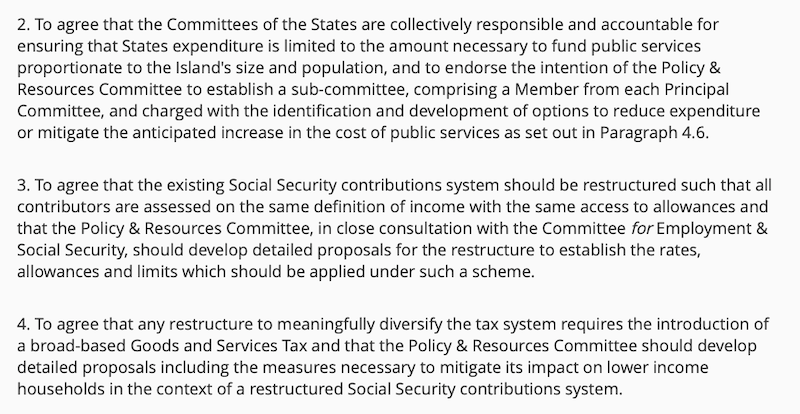

Pictured: The original propositions accompanying the Tax Review green paper.

Deputy Helyar denied suggestions that his Committee could have circulated the amendment earlier.

“This particular issue is one where we do need to maintain some forward momentum," he continued.

“We were debating the amendment right up until 11:30 [this morning] by email. Nothing has been sat on the fridge waiting to be submitted at an appropriate time."

He also emphasised, of the options available, that a GST was the “most progressive” option discussed to date if tax rises are needed and could be designed alongside a restructuring of Social Security contributions to protect those who are most financially vulnerable from new taxation.

The amendment was supported by 37 States members, with Deputy Murray abstaining and Deputy Liam McKenna rejecting the proposals.

General debate continues this morning.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.