The UK politicians behind a move to impose public beneficial ownership registers upon Guernsey have said they are in 'no doubt' they can compel us to do so.

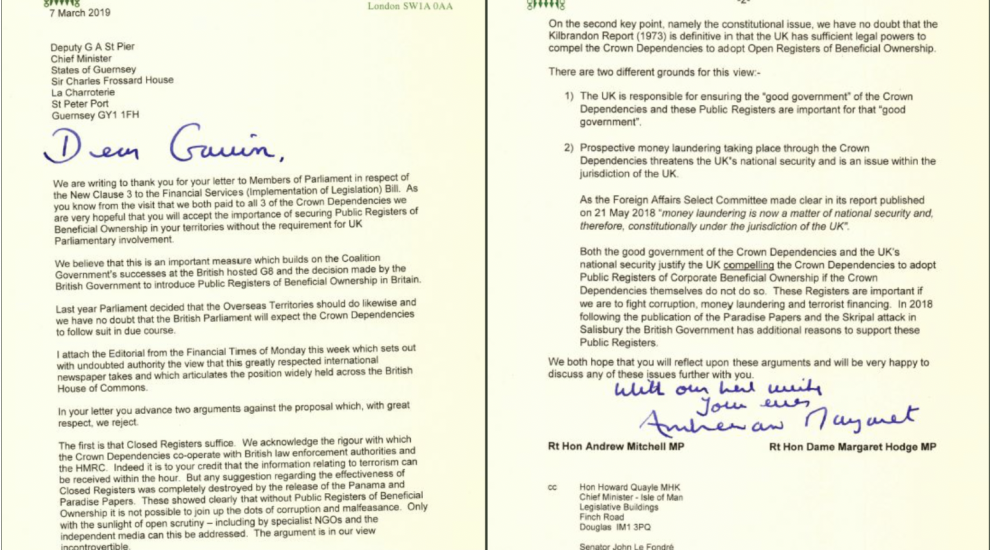

The letter to Guernsey's Chief Minister Gavin St Pier is the latest in a string of correspondence about attempts in Parliament to make the Crown Dependencies open up ownership registers.

In a letter to Members of Parliament this week, Deputy St Pier he proposed amendments, including that from the Rt Hon Andrew Mitchell MP and the Rt Hon Dame Margaret Hodge MP, to the Financial Services (Implementation of Legislation) Bill were based on common misperceptions about registers of beneficial ownership and transparency, in addition to stressing that the UK would be breaching a centuries-held constitutional rule that Parliament does not legislate for Guernsey on domestic matters without our consent.

However, MP's Mitchell and Hodge have written back, saying they are 'very hopeful that you will accept the importance of securing public registers of beneficial ownership in your territories without the requirement for UK Parliamentiary involvement'.

"We acknowledge the rigour with which the Crown Dependencies co-operate with British law enforcement authorities and the HMRC. Indeed it is to your credit that the information relating to terrorism can be received within the hour. But any suggestion regarding the effectiveness of Closed Registers was completely destroyed by the release of the Panama and Paradise Papers.

"These showed clearly that without Public Registers it is not possible to join up the dots of corruption and malfeasance."

The MPs also lean on an editorial from the Financial Times which "sets out with undoubted authority" their position.

In addition, they say that, on the constitutional issue, they are in 'no doubt that the Kilbrandon report (1973) is definitive in that the UK has sufficient legal powers to compel the Crown Dependencies to adopt Open Registers'.

Deputy St Pier responded, saying on Twitter that: "We will - of course - be responding and will publish response in due course, suffice to say for time being that there is much with which to disagree in this letter."

He also responded to Specsavers' inclusion in a list of 'UK billionaires' who have moved to 'tax havens' which fetured in The Times this week.

‘Notoriously frugal’ - use of this phrase in context of wealth, is intended to imply ‘mean’ whilst abjectly failing to refer to family’s philanthropy. How insulting. Island is enormously proud of their commercial success and their generous participation in community life. https://t.co/qobvx4pnvy

— Gavin St Pier (@gavinstpier) 8 March 2019

In response to the article including Specsavers, a spokesperson for the company said:

"It was a shame that The Times felt the need to include Doug and Dame Mary in this feature as the couple made Guernsey their home nearly 40 years ago, several years before they set up Specsavers in 1984, famously masterminding the business from their spare bedroom.

"They chose Guernsey, not because it was a low tax jurisdiction, but because they wanted to be closer to Mary’s parents, who retired to the island in the 1960s after holidaying here and falling in love with the place. ''Guernsey felt like home before we even moved here,'' Mary has said.

"It is also worth noting that the couple has always refuted their Sunday Times Rich List status based on how this is estimated. All Specsavers stores are registered in the UK and pay corporation tax at the full 19%. In total Specsavers businesses contributed £280m to the UK Treasury last year and as an employer of nearly 30,000 people, makes a valuable contribution to the UK economy in an increasingly challenging climate.

"We are grateful that Gavin St Pier recognises these facts and acknowledge his public support of the couple's contribution to the island and to the British economy as a whole."

Pictured top: The letter sent to Deputy Gavin St Pier

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.