MJ Hudson, which has offices in Guernsey and Jersey, is looking to sell parts of its business as it tries to reduce its debt and ensure sufficient working capital.

Its shares are currently suspended as problems with its accounts are investigated.

The asset management group is listed on the London Stock Exchange’s AIM and confirmed in a statement that it had engaged advisers Alvarez & Marsal to deal with interest that has been shown in certain divisions.

“In addition to demonstrating the value within MJ Hudson's operating businesses, the board believes that such transactions would provide the best opportunity to strengthen the Group's balance sheet by reducing its debt and to ensure that it has adequate working capital in the medium term,” it said.

There has been no indication which of its business lines is being looked at.

Pictured: MJ Hudson's local office is on the first floor of Heritage Hall in Le Marchant Street.

Sky News has reported that Inflexion Private Equity has approached MJ Hudson about acquiring one or more of its divisions.

MJ Hudson is headquartered in London, but has offices in 10 locations spread around the Channel Islands, the Americas and Europe.

The statement also confirmed that Ran Oren had been appointed as its interim chief financial officer following the suspension of Peter Connell in December.

On 17 October the company announced that it was in discussions with its auditors about “significant potential adjustments” in relation to its 2022 year-end accounts.

Then on 12 December it said that its shares would be suspended after it became aware of additional issues, including in relation to the reporting of historical trading of the business in the last financial year.

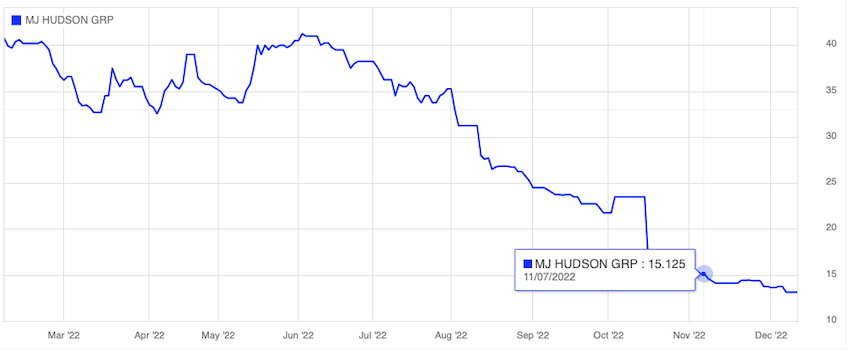

Pictured: MJ Hudson's share price had been falling before it suspended its shares in December.

Mr Connell suspension was also confirmed, while MJ Hudon indicated its audit would not be completed by the end of December 2022.

In the summer of 2021, MJ Hudson bought Guernsey-based fund administration Saffery Champness Fund Services.

At the time it said the deal would double its fund administration revenues in the Island.

It came soon after the acquisition of Guernsey-based regtech firm Clarus Risk, a deal done to extend the data and analytics services it could provide.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.