The idea of increasing the tax rate for Guernsey's top earners has been dismissed by Policy & Resources.

A steering group was set up by P&R to investigate ways of raising the £75m extra a year they say the island could need as the working population declines and Guernsey's healthcare needs increase.

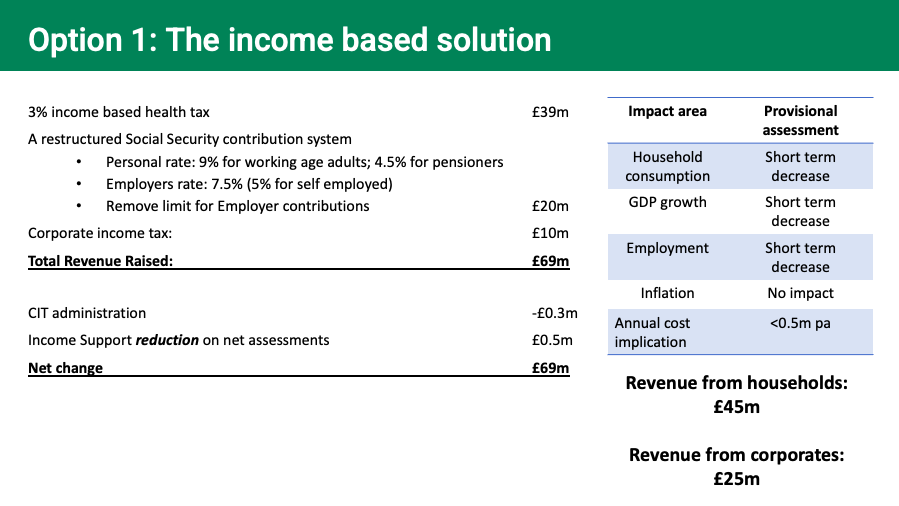

The group arrived at three options to combat this: a 3% income-based 'health' tax, a GST increasing over time to 8%, or a combination of income-based and consumption taxes.

The proposals - which favour the introduction of a Good and Services Tax - will be published this month and published for debate in the States as a green paper on 29 September, after which the preferred model will be fleshed out in more detail.

Pictured: Deputy Sasha Kazantseva-Miller wanted there to be more options on the table for the States Assembly to consider.

There appears to be little appetite for an income-based option from the steering group, who say it would increase reliance on income and working-age population, have the largest potential impact on short term labour/employment market, and have the largest potential impact on consumption.

As an alternative, the group considered tiered tax bands with higher rates for higher earners.

This would have focussed up to 50% of tax rises in the top 5% of households.

Pictured: Option 1 from the Tax Review is classified as a health tax.

However, this has been categorically dropped and is not listed an option.

P&R's Treasury Lead, Deputy Mark Helyar, said: "It would intensify our reliance on those who already pay a significant proportion of our tax base. As a strategy, it is quite high risk and could reduce competitiveness."

Notably, P&R has taken steps to prevent against amendments from States colleagues. It has done this by preparing the tax review policy letter as a green paper, which cannot be changed by States members.

Of his experience in the States to date, Deputy Helyar commented: "We have spent an awful amount of time on amendments, rather than the debates."

Pictured: Deputy Helyar expressed frustration with the amount of time spend debating amendments from the floor of the Assembly.

While many are unhappy with raising taxes - and while he reiterates he is personally against doing so - Deputy Helyar reiterated that the current States has inherited a catalogue of expensive work to complete.

He reiterated the need for sustainable, long-term solutions to the island's finances, which have taken a significant hit during the pandemic. Even without Covid-19, tough decisions would need to be made.

P&R has led on the Government Work Plan, which has defined the States' priorities and project for the term ahead, matched against the money in the public coffers and £200m of borrowing.

"The chickens have come home to roost," said Deputy Helyar of the tax review. "The decisions made in the past now need to be paid for in the future."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.