The States' financial position is so much stronger than they forecast this time last year that plans to borrow to fund capital projects have been shelved.

Deputies agreed last summer to spend an estimated £600million on capital projects during the current States' term until June 2025. They also agreed to borrow up to £200m to help pay for the projects.

But the annual Government Work Plan, published on Friday by the Policy & Resources Committee, reveals that this term's capital projects can now be funded from surpluses, reserves and investment returns following financial results last year which were nearly £100m better than expected

The Committee said that income was higher and expenditure was lower by a total of £61m and investment income was £28m better than forecast.

"Together, these factors have significantly improved the balance on reserves and uplifted the baseline position for some revenues, notably income tax. Given this improved position, the cumulative projections for 2022 to 2025 have improved by circa £68m," said the Committee.

"Overall, the improvements mean that there is now unlikely to be a need for any new external borrowing in this term to fund the capital portfolio. This is an excellent result which has been driven in large part by the faster recovery in 2021."

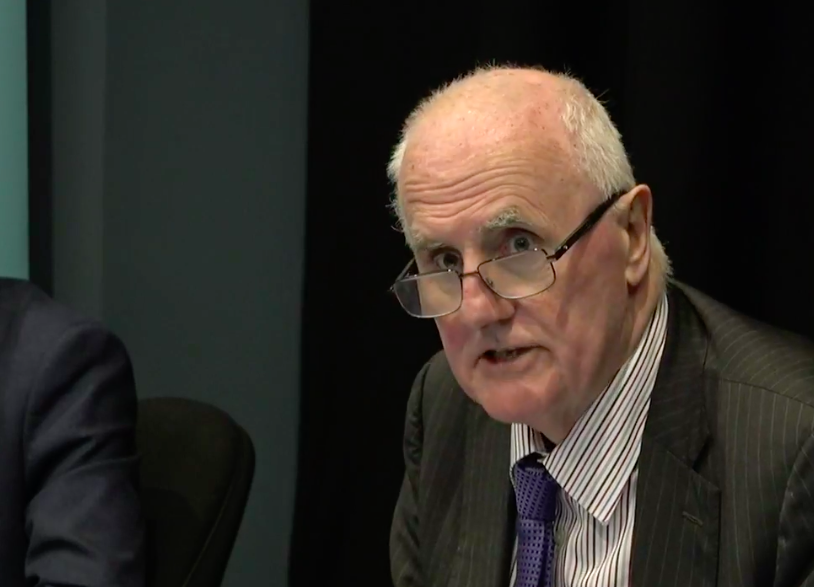

Pictured: Deputy Peter Ferbrache, the President of the Policy & Resources Committee, has repeatedly advised the States not to be complacent about their current financial position and to agree tax reforms to secure the future of public finances.

Despite the stronger financial performance than expected last year, the Committee is still projecting that States' reserves will be exhausted by the end of the current political term and that expenditure will exceed income by tens of millions of pounds a year in a few years' time.

"The revised projections indicate a surplus before capital expenditure over the Government Work Plan period which will fall from £25m in 2022 to £5m by 2025," said the Committee.

"The shrinking surplus comes about because of the demand pressures on public service expenditure, particularly in relation to health and care services, coupled with strain on revenues as a result of a reduction in the working population and the introduction of secondary pensions.

"These small surpluses are not sufficient to fund the necessary investment in island infrastructure. They are too small even to fund the everyday replacement of equipment and vehicles, renewal of roads and investment in property assets, classed as minor capital.

"The underlying position remains a structural deficit beyond this term which, for general revenue, is estimated to be approximately £50m when the long-term infrastructure funding needs are factored in.

"In addition, the States are running a deficit on the social security schemes, in particular the States’ pension, which have a long-term funding requirement of £34m a year. Therefore, the overall structural deficit remains in line with previous forecasts of £80-90m."

Pictured: In February, Deputy Charles Parkinson, a former Treasury Minister, told Express that the Policy & Resources Committee should resign if it could not secure States' approval for its flagship fiscal policy of a new goods and services tax.

The Committee has proposed a goods and services tax set at 8% or 5% as a better way of dealing with the projected shortfall than raising income tax and social security contributions or making substantial cuts to expenditure.

But its plans have faced sustained political and public opposition.

Instead, the States approved an alternative proposal from the Committee to investigate other options, consult more and return to the States for another debate in July this year. That second debate has now been postponed until later in the year, partly to allow a fresh examination of corporate tax.

Firm appointed to review whether companies could pay more tax

OPINION: States' policy plan much harder as tax review loses its way

OPINION: Why Guernsey needs to reform its company tax system

P&R wants more time before States debate GST and other taxes

FOCUS: Opposition across the States to P&R's latest GST plan

P&R wants to win public support for GST ahead of summer debate

EXPLAINED: Why the States' leaders believe GST is needed now

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.