With petrol prices rising again with the release of the 2019 Budget, Deputy Gavin St Pier has explained why fuel duty keeps going up, and what may happen in future as more people turn to electric vehicles.

As of midnight yesterday, the duty payable on a litre of petrol went up by 3.1pence - taking it to a total of 70.1p duty per litre.

The annual duty rise may anger some motorists, but it's not unexpected as duty increases are announced every year in the States budget in line with inflation, and sometimes an additional increase.

On this occasion, the P&R President's budget recommended:

While the increase has to go to the States of Deliberation for approval, along with the rest of the Budget, it is highly unlikely any deputy will challenge the rise in fuel duty. It has not happened in recent memory.

Deputy St Pier had previously warned the States, and the public, that he planned to put fuel duty up again this year, so it won't have been a surprise to anyone who follows local politics.

Pictured: Earlier this, Deputy St Pier warned of another 3p per litre going on fuel duty. You can read that report here.

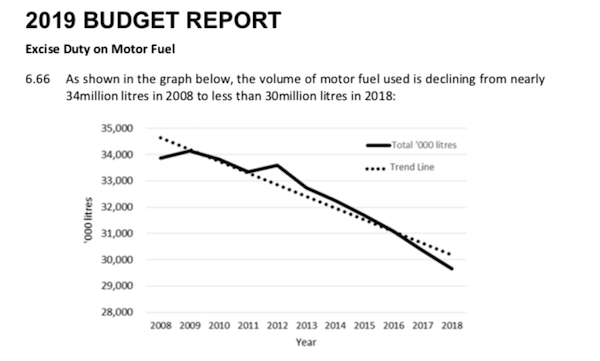

Giving an update to the States assembly in July, the P&R President said under current plans, this years budget would contain another petrol price rise, as the total volumes being sold continued to fall. That has now happened, meaning the amount of fuel duty motorists in Guernsey pays easily outstrips what drivers in Jersey and the UK pay.

The UK has seen fuel duty frozen for a ninth year in a row, leaving it at 57.95p per litre, while Jersey’s fuel duty is 45.47p, plus 5% GST.

Guernsey’s per litre fuel duty has surged since 2011 and will continue to rise, Deputy St Pier has warned.

2011: 4p

2012: 4p

2013: 1.5p

2014: 2.3p

2015: 3p

2016: 6.7p

2017: 3.5p

2018: 3.2p

Motorists currently contribute more than more than £20m. a year to States coffers – which Deputy St Pier said is revenue that has to be protected.

"Tobacco and alcohol are exactly following previous States policy. Fuel in a way is also following States policy of the last few years. We maintain that so long as we tax motor fuel, it contributes over £20million a year to fund public services that we all enjoy. That is a reality, we can't get away from that reality and therefore if fuel consumption is falling as a result of alternative fuels being used and more efficient energy use, then fuel duty will fall, unless we do something about it. So the only way we can do anything about it is by increasing rates of fuel duty, above the rate of inflation to compensate for that reduction in consumption.

"That is an unsustainable position, we cannot carry on doing that - we know that. We have to design a new system, that's not something that's going to happen overnight, but clearly in the meantime we need to ensure that it continues to contribute the same level of contribution to our public finances as it has before.

"That is really what's driving policy. It's unfortunate, and the only really small silver lining is that in June I said to the States it would be 3.2p but it's 3.1p so it's a small move in the right direction but unfortunately it is what it is."

Pictured: Deputy Gavin St Pier published the 2019 Budget yesterday.

Deputy St Pier said he couldn't have lowered the duty increase by any more than that, as the reality is, fuel duty contributes too much to the public purse.

"It's a very simple problem, challenge - if we do not raise revenue from this, where else will we raise it from? If it doesn't come from fuel it's going to come from somewhere else. So, I'm afraid that is the reality that everyone has to get used to.

"It's very easy to focus on a single source of revenue, a single tax and start comparing ourselves with other jurisdictions and so on, but the reality is, our government and our tax system takes around about 20% out of the economy, that is less than half the contribution that is taken out of the UK for example, and that's because we don't have VAT, and we don't have insurance premium tax, and we don't have capital gains tax and we don't have all the things which people experience in the UK.

There is something that P&R could do other than put fuel duty up every year - but they are reluctant to reintroduce motor tax.

A working party recommended an "alternative method for collecting income from motoring should be proposed" and that it could be "an annual fee per vehicle."

It was suggested that this be introduced from 2020, with a starting position of collecting 20% of the total annual revenue from excise duty on motor fuel with a commensurate reduction in the rate of excise duty on motor fuel. But, by a majority, the P&R Committee did not support that recommendation.

The Budget includes a statement from P&R that the committee was"not prepared to propose the introduction of an annual fee for vehicles which use fossil fuels as it is considered to be akin to the reintroduction of the previous motor tax regime.

"However, Members do accept that the current system is not sustainable, particularly over the longer-term and recognise that an alternative method is required that will ensure that a contribution is received from all vehicle users irrespective of the fuel source."

Pictured: It's easy to see the decline in fuel consumption, but it doesn't make it easy for the motorist to consume rising fuel duty costs.

Finding an alternative to fossil fuels and fuel duty charges in the long run is something the States have to tackle. The twenty-three point Policy and Resources plan, prioritised by the States of Guernsey to deliver the outcomes of the 'Future Guernsey' plans includes the development of an "over-arching energy policy which includes consideration of environmental and energy related taxes so as to explore ways to help ensure that we have a sustainable tax base that is supportive of the Island’s approach to energy."

Therefore, P&R said it "intends to work closely with the Committee for the Environment & Infrastructure which is leading on the energy policy development to consider alternative and innovative ways for generating sustainable revenues relating to motoring, with particular emphasis on the early introduction of a means of deriving income from vehicles that do not use fossil fuels."

For now though, despite the continued fall in volumes of motor fuel being bought, and to maintain the real value of income derived from excise duty on motor fuel., it has gone up again this year. However, P&R's budget report states that "the average total amount paid in duty per individual will not increase in real-terms due to a lower volume of fuel consumed as a result of increased efficiency of engines and changes in driving habits."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.