Safehaven – a Guernsey-based fiduciary company – has been fined £100,000 for failing in its responsibilities to avoid facilitating high risk individuals.

The firm allows high net worth individuals to set up companies that in turn own and manage luxury aircraft and yachts.

The Guernsey Financial Services Commission visited the offices of Safehaven in October 2016, to assess the effectiveness of its policies and procedures when filtering out and identifying illegal and high-risk activity.

Breaches of compliance regulation were discovered in at least nine files.

Pictured: Safehaven had a base of many ultra-high net worth individuals and Politically Exposed Persons (PEPs).

The public statement has been made available on the GFSC’s website. It includes examples of how and when various rules and regulations were broken.

The firm failed in the following areas, when dealing with certain companies created by high net worth individuals:

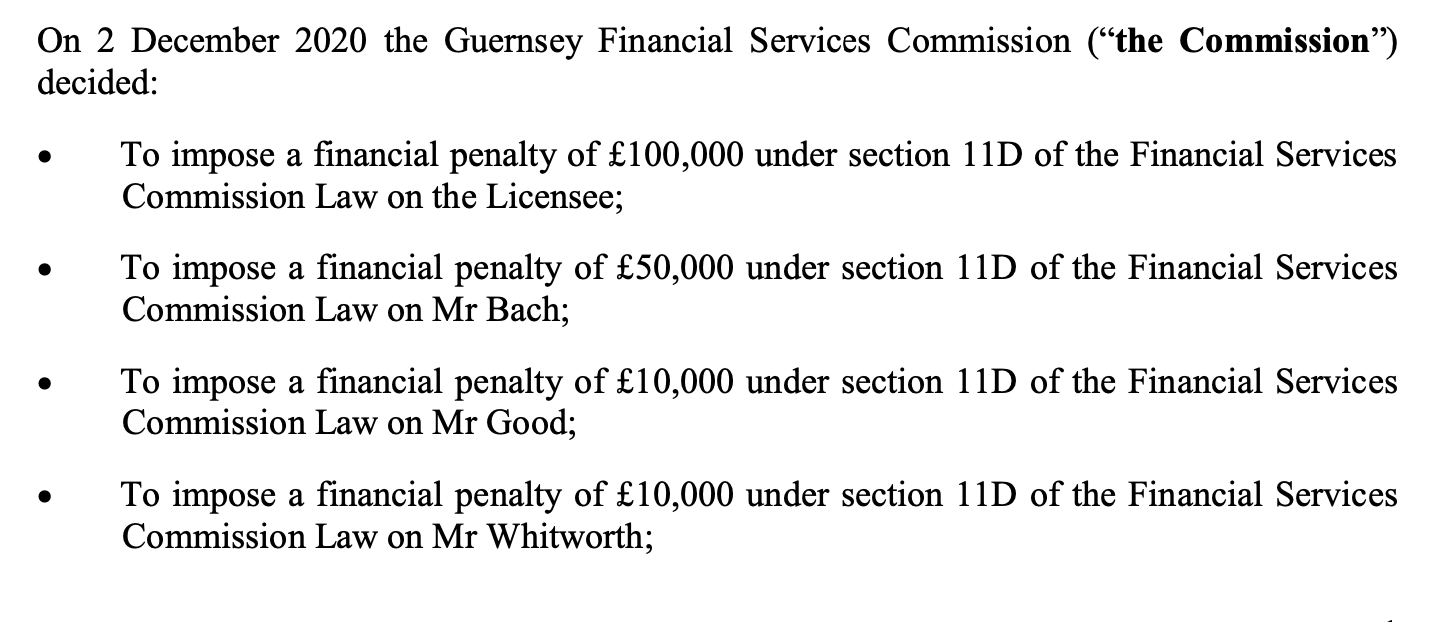

Pictured: The 100% stakeholder and a number of company Directors were also personally fined by the GFSC.

The investigation identified various incorporated companies dating back to 2006. The high net worth individuals involved with these companies had been involved in a whole raft of illegal activity, ranging from money laundering to embezzling and instances of international fraud.

The seriousness of these compliance failings have led to a series of hefty fines for all involved.

“The Commission expects firms to remain vigilant at all times, especially when providing services to high-risk clients as they can often present particular challenges around potential money laundering and/or terrorist financing from the proceeds of crimes such as fraud, bribery and corruption,” said a spokesperson for the GFSC.

The GFSC says the reputation of Guernsey as a financial centre cannot be tarnished by local businesses being careless.

“In some cases Politically Exposed Persons (PEPs) have been known to use their positions to exploit public funds in their countries for personal gain which then deprives those countries of much needed funds to tackle issues such as health care, schooling and poverty. It is important for the Bailiwick, as an International Finance Centre, to take appropriate and proportionate measures to address such significant reputational risks. That is why the Commission, through its Financial Crime Division, conducts regular onsite visits at local financial services firms to ensure they are taking the necessary measures to combat all aspects of financial crime”.

Pictured top: Guernsey was named in a criminal investigation against one individual who had dealings with Safehaven.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.