Social Security contributions for employers and employees are set to increase year-on-year, with Employment & Social Security saying the cost of doing nothing is the depletion of long-term care funds in the next few decades.

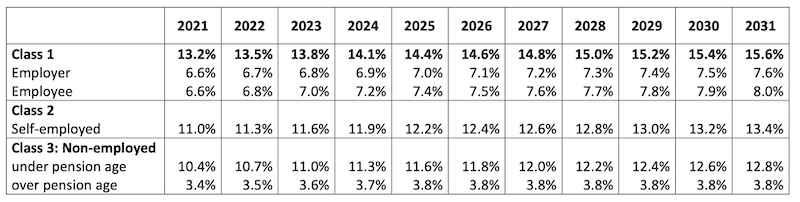

If approved during the upcoming October States debate, both employers and employees’ contributions into the Guernsey Insurance Fund will increase by 0.1% each, equating to an overall increase of 0.2% every year for the next ten years.

In a four-year plan, ESS has proposed increasing contributions into the Long-term Care Insurance Fund by 0.1% each year.

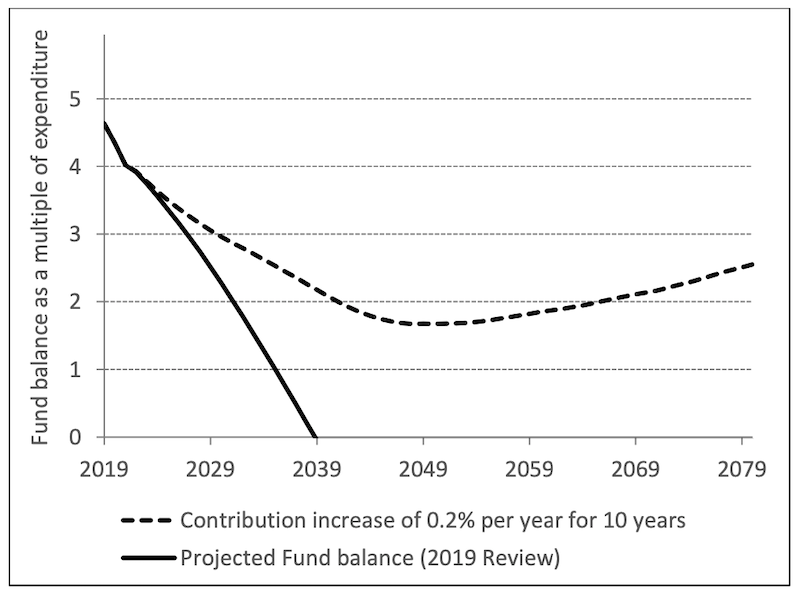

ESS raised major concerns about the long-term health of these funds in its 2021 annual report, and the Supported Living and Ageing Well Strategy (SLAWS), with current contribution rates not being enough to support either fund much longer. With current contribution rates, the LCIF will be depleted by 2053 and the GIF by 2039.

“The unsustainability of these two funds, which are relied on by many islanders, will come as no surprise to most people, and should certainly come as no surprise to States Members,” said President of ESS, Deputy Peter Roffey.

Pictured: ESS has compared the impact of 'action' to 'inaction' in its policy letter to the States’ Assembly.

The GIF supports people in Guernsey through old age and during periods of bereavement and unemployment, among other things. The LCIF helps part-fund the cost of private nursing care and stays in residential homes.

As an example, the proposed change in contribution rates will increase revenue to the GIF in 2022 by an estimated £1.22m.

The Assembly will be asked to not only agree to these increases, but to review them every year with Policy & Resources to make sure they remain in line with the findings of the Tax Review which is currently being undertaken.

“The debate on the Tax Review may identify measures to improve the situation, but this is likely to take several years to put into effect,” said Deputy Roffey.

“We can’t continue to delay taking corrective action. The situation only becomes worse the longer it is left unaddressed.”

The implementation of these changes has been requested alongside several other amendments to contribution rates and earnings limits which you can see below:

In line with the States uprating policy, the full rate of States’ pension could also rise. A 2.4% increase would see an old age pension increased to £233.85 per week.

If agreed to, the incremental increase in contribution rates will come into effect from the 1 January 2022, and the pension rise from the 3 January 2022.

Deputy Roffey said inaction now will only lead to bigger problems in the future.

“We’ve made it clear in the past that, in their current position, these funds are not financially sustainable in the long-term, and this report highlights how near these funds are to being exhausted,” he said.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.