States income in 2021 is set to exceed budget forecasts by £46m - with Policy & Resources admitting surprise at the speed of the island's economic recovery.

The 2022 Budget is, however, accompanied by warnings that underlying financial pressures remain stark.

The majority of deputies who have spoken in the debate so far appear to oppose the proposals, while P&R has been accused of a "lack of understanding" of corporate tax by Deputy Charles Parkinson in a scathing speech advocating for the abolition of Zero-10.

The conclusion of debate has been deferred until next Wednesday as States members have their say on the potential introduction of new taxation designed to raise an extra £80m a year.

Pictured: P&R Treasury Lead Mark Helyar said the Committee remains in “listening mode” regarding tax rises and admits that P&R could have done more public engagement ahead of debate. “The real issue is not waste or large numbers of civil servants,” he told Express. “There will have to be tax rises. These are problems that are not going to go away.”

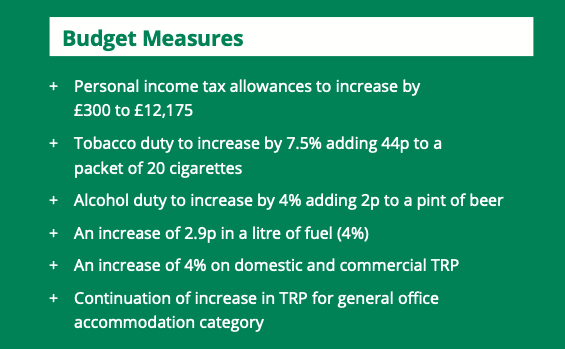

Today, the States Committee in charge of the public purse strings are presenting a more positive, short-term picture, and people’s tax thresholds will increase by £300 in 2022.

However, islanders will feel the pinch across the board, with fuel duty, TRP, alcohol and tobacco duty to increase above inflation in order to raise an extra £1m from islanders.

Meanwhile, the full budget report reveals the dire finances of Guernsey's trading assets and contains reference to a long-term review of the waste pricing strategy.

Pictured: P&R is under direction to raise £1m a year in extra tax through the measures above.

Guernsey Waste is, perversely, staring down the barrel of annual deficits because of how successful the island has been in reducing waste since the new kerbside collections came into force.

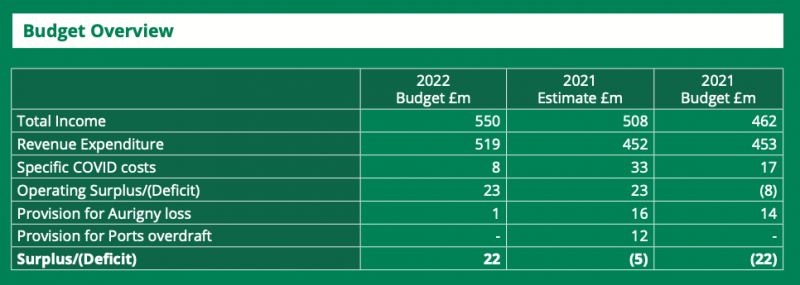

The 2021 Budget estimated a full year deficit of £22m, which worsened significantly to £33m following the second lockdown.

However, economic recovery will see tax take surge to nearly 5% above 2019 (pre-covid) levels.

Meanwhile, document and customs duty receipts have soared, due to the “buoyant” housing market and reduced access to duty-free products respectively.

Overall expenditure is £15m higher than expected and £6m of forecast savings have not been met, with P&R saying that matters such as civil service reforms were delayed as resources were “refocused” on responding to the pandemic.

Aurigny losses will amount to around £16m for the year and the accounts for several States Trading Entities makes for bleak reading.

Pictured: It is anticipated that £25m of business support expenditure will be incurred during 2021. This is made up of £12m in payroll co-funding; £11m in sector specific grants for visitor accommodation, visitor attractions and other travel related business; and £2m in grants to small businesses.

Guernsey Ports has been hit the hardest, with the States having to loan the company £12.5m across 2020 and 2021 because it does not have the reserves to cover millions of pounds of lost revenue. Provision has been made in the 2022 Budget for the States to write off these debts, subject to further review of the utility’s underlying financial position.

Overall, the States is projecting a £5m loss this year and a £22m surplus in 2022.

P&R said: “Accelerated recovery and increased revenues in 2021 have absorbed £15m of unanticipated expenditure, funded the increased Aurigny loss and Ports loss at the same time as reducing the deficit by £17m against estimates, which is a very positive result.

“Whilst this improved position is welcome, it does not fully translate to an ongoing improvement in the baseline position. The exceptional circumstances experienced in 2021 are not expected to continue and accumulating cost pressures are likely to place pressure on budgets as service demands increase.

Pictured: A Budget overview covering the 2021 estimates last October, the revised estimate nine months in, and the Budget that has been set for 2022.

"However, modelling indicates that there may be a £5-10m improvement in the forecast 2025 baseline position compared to that included in the Funding & Investment Plan.

“The bounce back has been beyond all comparator [jurisdictions],” said P&R President Peter Ferbrache, adding that people have been spending more money in the local economy given the travel situation.

P&R has also cited a busy finance sector and an “influx of open market people who have come here and invested in the island”.

P&R’s Treasury Lead Mark Helyar said the results have been “extraordinary” and that States revenue has surpassed expectations: “We are up in real terms revenue compared to 2019.”

The Budget for 2022 has been published today and can be read in full on the States website.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.