Alderney's politicians have warned of the consequences of not reforming the Bailiwick tax system as they prepare to welcome senior Guernsey representatives to talk through the headline tax and social security package.

The States of Alderney said in a statement that “the proposals mean that most people could take home more money than they do under the current tax system, so while GST will result in the cost of goods and services increasing, lower- and middle-income households would be better off overall”.

Members of Guernsey’s Policy & Resources Committee are visiting Alderney tomorrow for a public drop-in to talk to interested residents about the tax review and its package, which includes a 5% GST on almost everything.

The event is being held at the Butes Centre between 10:00 and 12:00, with States of Alderney members and the two States of Deliberation Representatives also in attendance present.

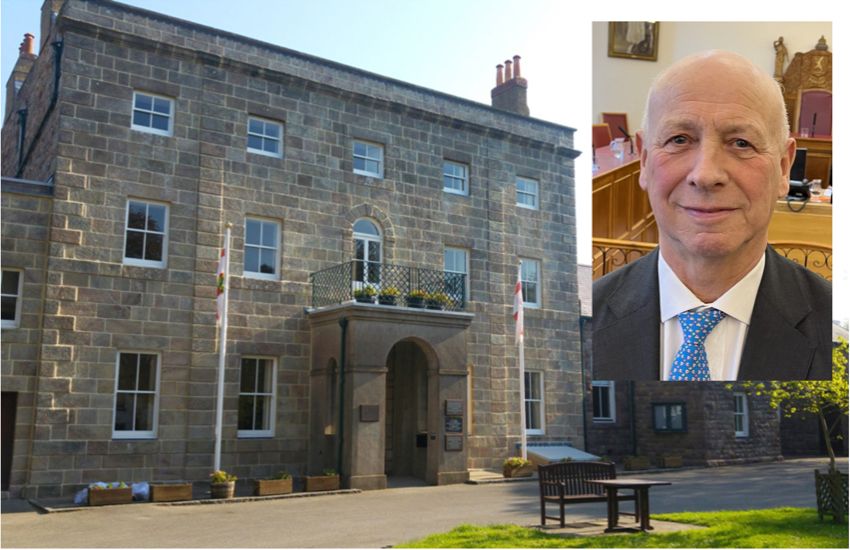

Nigel Vooght (pictured), Chairman of Alderney's Policy & Finance Committee, urged residents “to attend as this is so important for our future” and indicated support for the plan being led by Guernsey’s senior political committee.

“Although the introduction of GST may seem unpalatable, there is much merit in the balancing act proposed that could mean many islanders would in fact be better off,” he said.

“Obviously the proposals under discussion have specific implications to the Alderney community and islanders will have many questions about how it would affect them. This is an opportunity to find out the facts from those who have worked on the project and make our voice heard."

Pictured: Alderney Representative Steve Roberts is partly convinced by P&R's plan but said he will allow debate to help inform his vote in Guernsey next week.

Alderney Representative in the States of Guernsey, Steve Roberts said he shared Sarnian fears of an “across the board GST” in his native island because of its “median income of just £27,000 and a far higher cost of living”.

But he said the “help for the lower paid swings my sea saw… but it is a matter for debate and amendments.”

Policy & Resources are proposing a new 15% income tax band on earnings up to £30,000, introducing allowances for social security and increase the limit for income tax, increases to benefits and pensions to offset GST-inflation, and a cost support payment for those struggling but not eligible for benefits.

“The projects for the hospital, education, and harbour, are at risk should a revenue stream not be found. That sum has to be found,” Mr Roberts said.

He accepted that “these things can swing either way” and said he would “listen to the debate, listen to my island, and then decide”.

Mr Roberts said he and his colleague, Alex Snowdon, “are bound to vote as Alderney States directs on such a major issue”.

“It has to be fair but I feel it is a massive debate because it encompasses all of our future plan funding.”

The States of Guernsey will commence debate on Wednesday 25 January.

Parkinson makes the case for corporate reform

Alternative tax package promises greater States savings

Social security changes help poorer families and 'middle Guernsey'

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.