SPF Private Clients has published its commentary on the 2021 and 2022 mortgage market, highlighting a busy year last year and concerns with supply in the future.

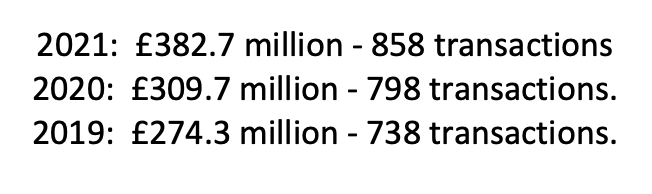

Managing Director, Pierre Blampied, said: “2021 experienced a very busy year in lending in house purchases with the volume of lending increasing by 23% on the previous year and the number of transactions up by 7%.”

“The ‘High Street’ lenders dominated the market, but Private Banks and niche lenders are also increasing business to meet demand for more bespoke mortgage options,” continued Mr Blampied.

“Lloyds finished the year as the leading house purchase lender for the third year in a row, with £99.3 million, though they lent less in this category than in 2020. HSBC ended 2021 in second position with close to £60 million, increasing the amount they lent by 142%. RBS (encompassing NatWest), and Skipton were close behind lending in excess of £50 million and Barclays finished off in fifth position, at £44.6 million.

“Thereafter we get into the Private Banks and more specialist lenders. Kleinwort Hambros, led this space followed by Butterfield and Investec who remain keen to assist and increased its lending in 2021.

“On the mainland the older borrowers’ market is a growing market and fortunately we have one lender, Marsden Building Society, offers products locally for this group, along with standard mortgages and interest only borrowing. Their position in the market and that of the Private Banks, shows that there is an appetite for ‘non-standard’ mortgages.

“So, what will 2022 bring? Estate agents expect the market to remain strong but have concerns about supply, and whilst it is good to see the States of Guernsey giving special dispensation to change out of use hotels into residential properties and the Guernsey Housing Association looking to increase the number of properties they have, this will all take time. The good news is that interest rates remain low and all of the providers we have locally are keen to lend with products to suit everyone from first-time buyers and growing families, to retirement age borrowers and High Net Worth individuals with complex requirements.”

Pictured top: Mr Blampied.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.